Agenda

Notice is hereby given that an Ordinary Meeting of

Council will be held at the Civic Centre, Dee Why on

Tuesday 28 February 2023

Beginning at 6:00pm for the purpose of considering and

determining matters included in this agenda.

Ray Brownlee

PSM

Chief Executive Officer

V2

OUR VISION

Delivering the

highest quality service valued and trusted by our community

OUR VALUES

Trust Teamwork

Respect Integrity Service Leadership

OUR OBLIGATIONS

I swear/solemnly

and sincerely declare and affirm that I will undertake the duties of the office

of councillor in the best interests of the people of the Northern Beaches and

the Northern Beaches Council and that I will faithfully and impartially carry out

the functions, powers, authorities and discretions vested in me under the Local

Government Act 1993 or any other Act to the best of my ability and judgement.

1.0 ACKNOWLEDGEMENT

OF COUNTRY

2.0 Apologies and applications for leave of

absence and remote attendance

3.0 Confirmation of Minutes of Previous Meetings

3.1 Minutes of

Ordinary Council Meeting held 13 December 2022................................... 4

3.2 Minutes of

Extraordinary Council Meeting held 24 January 2023............................... 4

4.0 disclosures of interest

5.0 Public Forum AND PUBLIC ADDRESS

6.0 Items Resolved by Exception

7.0 Mayoral Minutes

Nil

8.0 Chief Executive Officer's Division Reports

Nil

9.0 Corporate and Legal Division Reports.................................................... 9

9.1 Use

of Delegated Authority by the Mayor over Christmas and New Year Recess 2022/23...................................................................................................................................... 9

9.2 Quarterly

Review - December 2022........................................................................... 10

9.3 Monthly

Investment Report - November 2022........................................................... 23

9.4 Monthly

Investment Report - December 2022........................................................... 35

9.5 Monthly

Investment Report - January 2023............................................................... 48

10.0 Community and Belonging Division Reports......................................... 61

10.1 Council

Representation to the Quarantine Station Community Consultative Committee.................................................................................................................................... 61

11.0 Environment and Sustainability Division

Reports

Nil

12.0 Planning and Place Division Reports....................................................... 64

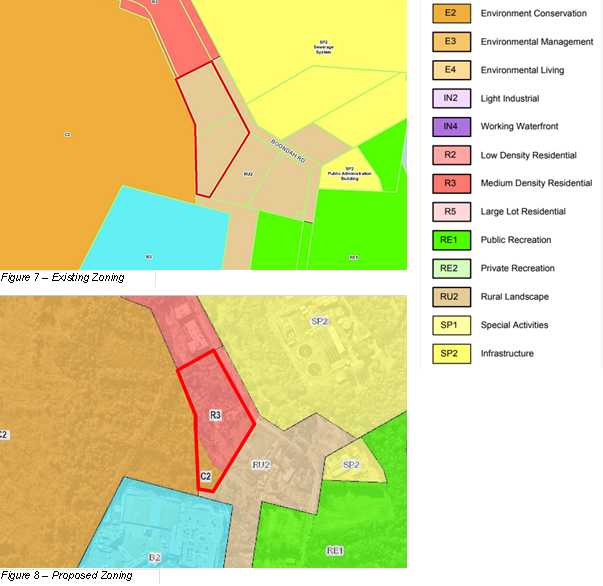

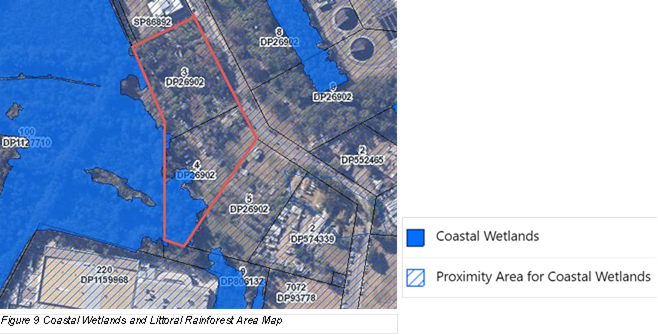

12.1 Planning

Proposal 10-12 Boondah Road, Warriewood PEX2022/0001................... 64

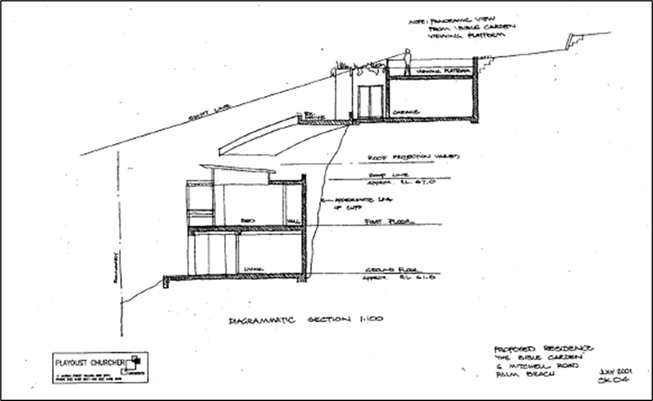

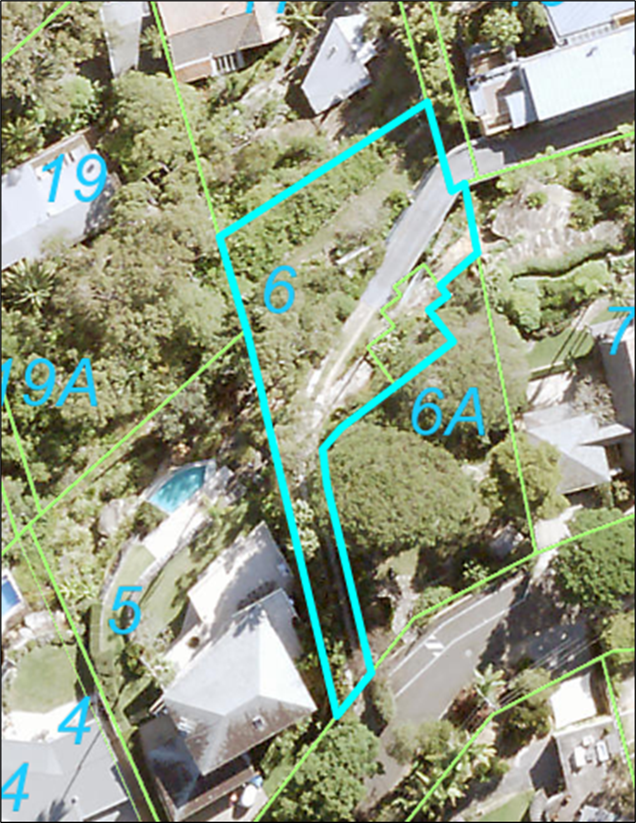

12.2 Planning

Proposal for 6 Mitchell Road, Palm Beach - PEX2022/0003..................... 93

13.0 Transport and Assets Division Reports............................................... 114

13.1 Response

to Notice of Motion No 36/2022 - Potholes on Local Roads.................. 114

14.0 Workforce and Technology Division Reports

Nil

15.0 Notices of Motion............................................................................................ 117

15.1 Notice

of Motion No 1/2023 - Parking Restrictions Request, Pittwater Road, Collaroy 117

15.2 Notice

of Motion No 2/2023 - Beach Safety Signs................................................... 118

15.3 Notice

of Motion No 3/2023 - Cashless Gaming Card Reform................................ 121

15.4 Notice

of Motion No 6/2023 - Brewarrina Sister City Youth Program..................... 122

15.5 Notice

of Motion No 7/2023 - Urgent Request for a Safety Audit of Electric Bike,

Electric Scooter and Other Bike Usage on Northern Beaches Shared Paths, Bike

Paths and Footpaths.................................................................................................................. 123

15.6 Notice

of Motion No 8/2023 - Conservation Zones.................................................. 125

15.7 Notice

of Motion No 4/2023 - Duffys Forest Community Bridle Trail....................... 129

15.8 Notice

of Motion No 5/2023 - Daydream Street, Warriewood................................. 132

16.0 Questions with Notice................................................................................... 133

16.1 Question

With Notice No 1/2023 - Footpath, Seaview Road, Mona Vale............... 133

16.2 Question

With Notice No 2/2023 - GIPA Applications............................................. 134

16.3 Question

With Notice No 4/2023 - Dog Access at Cabbage Tree Bay Aquatic Reserve at the

Bower in Manly................................................................................................... 135

17.0 Responses to Questions With Notice..................................................... 136

17.1 Response

to Question With Notice No 22/2022 - Development Application Outcomes for

Former Pittwater Local Government Area............................................................... 136

17.2 Response

to Question With Notice No 23/2022 - Grandview Drive, Seaview Avenue, Newport -

Traffic Changes....................................................................................... 137

17.3 Response

to Question Taken on Notice No 2/2023 - SEPP Background............... 139

17.4 Response

to Question With Notice No 3/2023 - NSW Ombudsman Report - 2021-22

Northern Beaches Council Complaints Breakdown................................................. 141

18.0 matters proposed to take place in closed

session...................... 143

18.1 Exemption

from Tendering for Provision of Groceries for Children's Services, Glen Street

Theatre and the NSW Rural Fire Service

18.2 RFT

2022/109 - Software Provider for Children's Services Tender Outcome

18.3 RFT

2022/224 - Manly Dam Link Trail Boardwalk

18.4 RFT

2022/100 - Irrigation Maintenance Services

18.5 Response

to Notice of Motion No 38/2022 - Soft Plastics Recycling

18.6 Minutes

of the Property Steering Committee Meeting held on 28 July 2022 and 21

September 2022.

18.7 Facilitating

a Group Power Purchase Agreement for Northern Beaches Businesses

19.0 Report of Resolutions Passed in Closed Session

|

|

Ordinary Council Meeting

|

|

28 February 2023

|

1.0 ACKNOWLEDGEMENT OF COUNTRY

|

As a sign of

respect, Northern Beaches Council acknowledges the traditional custodians of

these lands on which we gather and pays respect to Elders past and present.

|

2.0 Apologies AND applications for leave of

absence AND REMOTE ATTENDANCE

|

In accordance

with Part 6 of the Code of Meeting Practice, Council will consider apologies,

requests for leave of absence, and requests to attend meetings remotely via

audio-visual link.

|

3.0 Confirmation

of minutes

3.1 Minutes

of Ordinary Council Meeting held 13 December 2022

|

Recommendation

That the minutes of the Ordinary Council

Meeting held 13 December 2022, copies of which were previously circulated, be

confirmed as a true and correct record of the proceedings of that meeting.

|

3.2 Minutes

of Extraordinary Council Meeting held 24 January 2023

|

Recommendation

That the minutes of the Extraordinary

Council Meeting held 24 January 2023, copies of which were previously

circulated, be confirmed as a true and correct record of the proceedings of

that meeting.

|

4.0 disclosures of interest

|

In accordance

with Part 17 of the Code of Meeting Practice, all Councillors must disclose

and manage any conflicts of interest they may have in matters being

considered at the meeting.

A Councillor who

has a pecuniary interest in any matter with which Council is

concerned, and who is present at a meeting of Council at which the matter is

being considered, must disclose the nature of the interest to the meeting as

soon as practicable.

The Councillor

must not be present at, or in sight of, the meeting:

a.

at any time during which the matter is being considered or discussed,

or

b.

at any time during which Council is voting on any question in relation

to the matter.

A Councillor who

has a significant non-pecuniary conflict of interest in a matter under

consideration at a Council meeting, must manage the conflict of interest as

if they had a pecuniary interest in the matter.

A Councillor who

determines that they have a non-pecuniary conflict of interest in a matter

that is not significant and does not require further action, when

disclosing the interest must also explain why the conflict is not significant

and does not require further action in the circumstances.

As required by

Council’s Code of Conduct and the Information and Privacy

Commission’s Information Access Guideline 1, returns made by designated

persons are routinely tabled at Council meetings and published on

Council’s website.

|

5.0 Public Forum AND PUBLIC ADDRESS

|

In accordance

with Part 5 of the Code of Meeting Practice, residents, ratepayers,

applicants or other persons may request to address Council in relation to any

one matter related to the general business of Council but not the subject of

a report on the agenda (Public Forum) and no more than two matters listed for

consideration on the agenda (Public Address).

|

6.0 Items Resolved by EXCEPTION

|

In accordance

with Part 14 of the Code of Meeting Practice, items that are dealt with by

exception are items where the recommendations contained in the staff reports

in the agenda are adopted without discussion.

|

|

|

Report To Ordinary Council MEETING

|

|

ITEM NO. 9.1 - 28 February 2023

|

9.0 Corporate and Legal

Division Reports

|

ITEM 9.1

|

Use

of Delegated Authority by the Mayor over Christmas and New Year Recess

2022/23

|

|

REPORTING

MANAGER

|

Executive

Manager Governance & Risk

|

|

TRIM

file REF

|

2022/677650

|

|

ATTACHMENTS

|

Nil

|

purpose

To inform Council how the delegated

authority granted to the Mayor by the Council over the 2022-23 recess was

exercised.

REPORT

In November 2022 Council granted authority to the Mayor to

make decisions on the governing body’s behalf on urgent

matters over the recess period 14 December 2022 to 31 January 2023 inclusive.

The resolution (351/22) required a report to be provided to the 28 February

2023 Council meeting outlining how the delegated authority

was exercised.

This report is to advise Council there were no decisions

made under the delegation of authority by the Mayor over the recess period.

LINK TO COUNCIL STRATEGY

This report relates to the Community

Strategic Plan Outcome of Good Governance Goal 19 - Our Council is transparent

and trusted to make decisions that reflect the values of the community.

FINANCIAL CONSIDERATIONS

There are no financial considerations in

relation to this report.

ENVIRONMENTAL CONSIDERATIONS

There are no environmental considerations

in relation to this report.

Social considerations

There are no social considerations in

relation to this report.

governance and risk

considerations

This report meets the requirements of

Council resolution 351/22 Council Delegated Authority - Christmas / New Year

Recess 2022-23.

RECOMMENDATION OF Director Corporate and Legal

That Council note the report.

|

|

Report To Ordinary Council MEETING

|

|

ITEM NO. 9.2 - 28 February 2023

|

|

ITEM 9.2

|

Quarterly

Review - December 2022

|

|

REPORTING

MANAGER

|

Executive

Manager Strategy & Performance AND

EXECUTIVE MANAGER FINANCIAL PLANNING AND SYSTEMS

|

|

TRIM

file REF

|

2022/774756

|

|

ATTACHMENTS

|

1 ⇨Progress of the Operational Plan - December 2022

(Included In Attachments Booklet)

2 ⇨Quarterly Budget Review Statement - December 2022

(Included In Attachments Booklet)

3 ⇨Stronger Communities Funds and New Council

Implementation Fund - December 2022 (Included In Attachments Booklet)

|

purpose

To present financial and service performance results for the

period ended 31 December 2022, and a progress report on

the expenditure from the $36.1 million Stronger Communities Fund (SCF) provided by the New South Wales (NSW) Government.

executive summary

This

report details Council’s service performance results and the consolidated

financial position for the period ended 31 December 2022. The Quarterly Review

is a progress report on the implementation of the Operational Plan 2022/23.

The

operating result (which includes capital grants and contributions) for the

financial year is forecast to increase by $5.8 million to a surplus of $48.4

million. Excluding capital grants and contributions the result is forecast to

improve by $0.8 million, from a surplus of $6.6 million to a surplus of $7.4

million.

Capital

expenditure is forecast to increase by $2.1 million to $108.2 million,

primarily due a new $9.1 million Regional and Local Roads Repair Program grant,

of which $3.4 million will be spent this financial year.

Council’s

budget remains balanced. Investment returns remain strong following rising interest

rates, with an additional $0.8 million expected (which relates to Kimbriki and

restricted reserve funds). An additional $1.4 million from development

contributions is also anticipated.

Council’s

2022/23 Operational Plan contains 196 actions relating to both operational and

capital projects. Of the 196 actions the majority (86%) are progressing on

schedule, including 23 completed. The Plan also contains performance measures.

Of the 37 reportable measures, 81% have met or approached their targets this

quarter.

The Report also details expenditure

associated with the implementation of Council’s SCF projects supported by

NSW Government funds, including an update on the performance space being built

at Mona Vale Public School and construction of the new Long Reef Surf Life

Saving Club.

RECOMMENDATION OF Director Corporate and Legal

That Council:

1. Note the December 2022

Quarterly Budget Review Statement.

2. Approve the following changes

to the Current Forecast in the December 2022 Quarterly Budget Review Statement:

A. An

increase in the forecast surplus from Continuing Operations, which includes

Capital Grants and Contributions, of $5.786 million to $48.356 million.

B. An

increase in capital expenditure by $2.101 million to $108.175 million.

3. Note the Quarterly Report on

Service Performance for the period ended 31 December 2022.

4. Note

the Quarterly Report on expenditure of funds from the Stronger Communities Fund

for the period ended 31 December 2022.

BACKGROUND

Northern Beaches Council’s

Operational Plan 2022/23 was adopted on 28 June 2022. The Operational Plan is

for the period 1 July 2022 to 30 June 2023.

The Quarterly Budget Review Statement is a

regular progress report against the Operational Plan 2022/23. It has been

prepared in accordance with the requirements of the Local Government (General)

Regulation 2021 (Cl203) and essential element 4.9 of the Integrated Planning

and Reporting Guidelines (September 2021), namely that the Responsible

Accounting Officer report quarterly on a budget review statement and the Chief

Executive Officer report at least every six months on the principal activities.

The Quarterly Budget Review Statement

provides reporting to adequately disclose Council’s overall financial

position as well as provide sufficient information to enable informed decision

making while ensuring transparency.

The Quarterly Report on Service Performance

discloses the progress of key services in the delivery of projects and against

performance measures.

The report includes updates for the period

ending 31 December 2022:

· Service performance

· Financial performance and position, contracts listing and

recommended changes to the budget

· The outcomes delivered from the $36.1 million Stronger Communities

Fund (Attachment 3).

Overview of service performance

A report

on Council’s service performance is provided at Attachment 1. This is a comprehensive report on Council’s 196 operational and

capital projects, 37 reportable service performance measures, seven workload

measures and service highlights across our 16 key services.

Council is making good progress towards

achieving its performance targets and delivering operational and capital

projects. Most missed targets and half the delayed projects are due to external

factors including storm events, persistent wet weather, COVID and third-party

issues.

A summary of our

performance is outlined below.

|

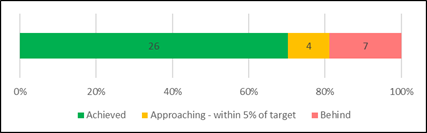

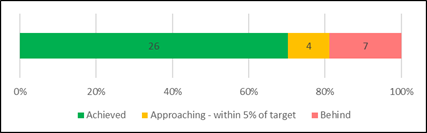

Performance measures

Overall 81% of Council’s 37 performance measures met or approached the

target. Of the 11 measures that did not achieve their target, most were impacted by weather

events, third-party issues or reduced demand.

|

|

|

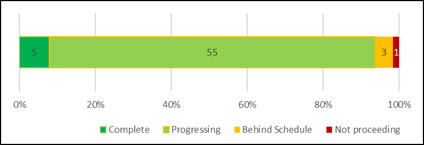

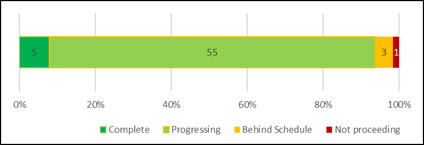

Operational

project progress

Of the 64

operational projects, 94% are progressing on schedule.

Of the

three projects behind schedule, two were affected by the response to storms

and persistent wet weather. One other project will not proceed as the need

has been fulfilled by other initiatives.

Target:

80% complete/on schedule as at 30 June 2023

|

Two operational projects

were completed this quarter:

· Review environmental compliance tools and

procedures to improve customer experience

· Currawong Cottages and surrounds - Refurbishment, Modernisation and

Environmental works

|

|

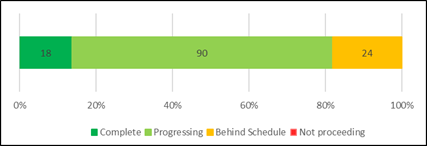

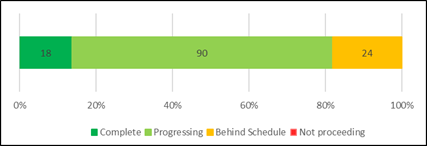

Capital project progress

Of the 132

capital projects, 82% are complete or progressing on schedule.

Of the 24

projects behind schedule, half are due to external factors such as storm

events, persistent wet weather, COVID or third party delays.

Target:

80% complete/on schedule as at 30 June 2023

|

13 capital

projects were completed this quarter:

· Ashley Parade Reserve - new playground

· Church Point Masterplan Boardwalk

extension

· Coast Walk Aboriginal art and signage

· Currawong Cottages

· Gallery Art Work Purchases

· Jacka Park playground upgrade

· Kimbriki landfill cell development area

4A

· Kimbriki landfill cell development

mid-west

· Library Bookstock

· Mona Vale Surf Life Saving Club

· Narrabeen Lagoon pedestrian and cycle

bridge

· North Curl Curl Youth Facility

· Sydney Lakeside Holiday Park renewal

|

Service Review Program

The Office of Local Government’s

Integrated Planning and Reporting Guidelines for Local Government in NSW places

requirements on Council in relation to service reviews. Essential Element 4.17

states that “…the Operational Plan must specify each review to be

undertaken in that year.” At the time of the development of the 2022/23

Operational Plan, Council had completed a holistic review of all its 57

services with a resulting program of actions to be undertaken. These actions

are being implemented based on available resources.

In August 2022, a workshop was held with

Councillors to look at the next step in the service review program. As a

result, reviews of the following services will be complete or in progress by

June 2023:

· Facilities Management and Services (Building Maintenance) - complete

· Street Sweeping – complete

· Roads and Transport Infrastructure (Road Maintenance) – in

progress

· Public and Environmental Health – in progress.

As the Service Review oversight committee,

Council’s Audit, Risk and Improvement Committee will be updated with the

progress of each Service Review. Any recommendations that significantly impact

service levels and require a decision of Council will be brought to Council for

consideration.

Stronger Communities Fund (SCF)

Attachment 3 outlines the progress of

projects funded by the NSW Government’s SCF. While four projects

are ongoing, a range have been completed such as accessible playgrounds,

cycleways, surf lifesaving clubs, netball courts and performance spaces.

Overview of Financial Performance

Responsible Accounting Officer Budget

Review Statement

The following statement is made in

accordance with Clause 203(2) of the Local Government (General) Regulations

2021:

“It is my opinion that

the Budget Review Statement for Northern Beaches Council for the period ending

31 December 2022 indicates that Council’s projected financial position at

30 June 2023 will be satisfactory, having regard to the projected estimates of

income and expenditure and the original budgeted income and expenditure.”

David Walsh Chief

Financial Officer, Northern Beaches Council.

Income Statement – progress and

forecast changes

The attached Quarterly Budget Review

Statement (QBRS) provides an overview of Council’s progress against the

annual budget at the end of the December 2022 quarter and provides explanations

for major variations that result in recommendations for budget changes.

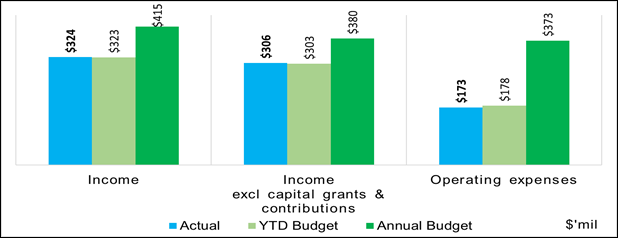

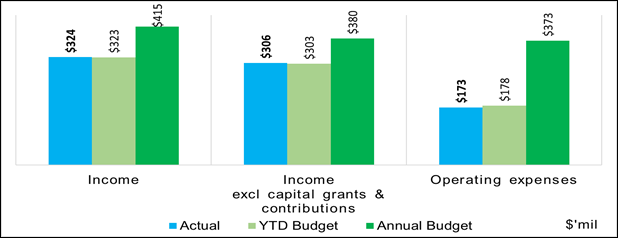

Operating budget summary – as at 31 December 2022

($’ million)

For the six months to 31 December 2022 the

operating result (incl capital grants and contributions) is $5.5 million

favourably ahead of budget, primarily due to phasing of expenditure and income

items partially offset by the timing of the release of capital grant funding

against project expenditure milestones and costs associated with natural

disasters.

The operating surplus which includes capital grants and

contributions for the financial year is forecast to increase by $5.8 million to

$48.1 million. Income is forecast to increase by $7.2 million while operating

expenses will increase $1.5 million (primarily due to higher than expected

investment income offset by expenditure on storm events and capital grants and

contributions).

The operating result excluding capital grants and

contributions is forecast to improve by $0.8 million to a $7.4 million surplus.

These overall movements are summarised in the table below, under the

‘Recommended Changes’ column.

Operating budget as at 31 December 2022 – summary of

recommended changes

|

|

Annual

|

Year to date

|

|

$’000

|

ORIGINAL Budget

|

REVISED Budget

|

Recommended changes

|

CURRENT Forecast

|

Actual

|

Approved

Budget

|

Variance

|

|

Income

|

400,340

|

415,485

|

7,242

|

422,727

|

323,549

|

322,992

|

557

|

0%

|

|

Operating

expenses

|

(361,781)

|

(372,915)

|

(1,456)

|

(374,371)

|

(172,815)

|

(177,764)

|

4,949

|

3%

|

|

Surplus

/ (Deficit)

|

38,559

|

42,569

|

5,786

|

48,356

|

150,734

|

145,228

|

5,506

|

4%

|

|

Surplus

/ (Deficit) before Capital Grants

& Contributions

|

8,795

|

6,646

|

764

|

7,410

|

133,602

|

125,729

|

7,873

|

6%

|

Attachment 2 ‘Quarterly Budget Review

Statement - December 2022’ provides further information on the proposed

variations to the budget.

Income Year to Date (YTD) Analysis

Total income

at the end of December 2022 is $323.5 million which is $0.6 million above the

forecast. The principal reasons for this variance are as follows:

Income as at 31 December 2022 – Variance to Approved

YTD Budget

|

YTD Variance $’000

|

Details – Favourable / (Unfavourable)

|

|

184

|

Rates

and Annual Charges

|

|

|

|

|

1,004

|

User

Charges & Fees

|

|

|

· Stronger than anticipated income:

o Kimbriki Waste & Recycling Centre

$0.6m

o Sydney Lakeside $0.4m

· Lower income sources including:

o Restoration charges ($0.2m)

o Child Care ($0.2m)

· Timing of revenue recognition for

development assessments $0.5m

|

|

301

|

Investment

Fees and Revenues

· Stronger than anticipated income due to

higher interest rates and higher investment balances

|

|

(383)

|

Other

Revenue

· Stronger than anticipated income:

o Investment losses recovered $0.3m

o Kimbriki recycling income $0.1m

· Lower income sources including:

o Parking fines ($0.8m)

o Other fines ($0.1m)

· Timing of revenue recognition for

advertising on Council structures $0.2m

|

|

1,653

|

Grants

and Contributions – Operating Purposes

|

|

· Disaster grant funds received in advance

$1.9m

· Library Subsidy Grant received earlier

than anticipated $0.8m

· Timing of revenue recognition of grants

to match expenditure of funds including the B-Line offset tree planting

program from Mona Vale to Seaforth Road corridor ($0.8m) and Currawong works

($0.3m)

|

|

(2,367)

|

Grants

and Contributions – Capital Purposes

|

|

· Development contributions higher than

expected $2.9m

· Timing of revenue recognition of grants

to match expenditure of funds including:

o Queenscliff headland access ramp ($0.9m)

o Footpath renewal works ($0.8m)

o Traffic facility delivery program ($0.8m)

o Active Transport Corridor ($0.6m)

o Clontarf Reserve Tidal Pool ($0.6m)

o Streets as Shared Spaces (Avalon) ($0.4m)

· Delay in payment of the Duffys Forest

Rural Fire Station contribution ($0.7m) and Long Reef SLSC contribution

($0.4m)

|

|

(261)

|

Other

Income

|

|

|

· Property leases including Lakeside

Holiday Park ($0.2m)

|

|

426

|

Gain

on disposal of assets

|

|

|

· Timing of proceeds on sale of plant &

equipment

|

|

557

|

TOTAL

INCOME VARIANCE – YTD ACTUALS WITH YTD BUDGET

|

Operating

Expenses Year to Date (YTD) Analysis

Total operating expenses at the end of December 2022 is

$172.8 million, which is $4.9 million under the forecast. The principal reasons

for this variance are as follows:

Operating expenses as at 31 December 2022 – Variance

to Approved YTD Budget

|

YTD Variance

$’000

|

Details – Favourable / (Unfavourable)

|

|

979

|

Employee

Benefits and Oncosts

|

|

|

Lower primarily

due to vacancies in Corporate Support, Transport and Environmental Compliance

Services. This was partially offset by higher expenditure in Children’s

Services due to a higher utilisation of casual staff due to the

unavailability of agency staff and trainees.

|

|

44

|

Borrowing

Costs

|

|

|

|

|

5,325

|

Materials

and Services

|

|

|

· Timing of works:

o IT and communications $1.4m

o Bush regeneration $0.7m

o Tree works $0.6m (delays in B-Line grant

funded project)

o Land use planning $0.4m

o Environment and floodplain $0.5m (incl

grant funded projects)

o Recreation and sportsfields $0.4m (Cromer

High School Sportsfield)

o Staff training programs $0.3m

o Utilities $0.3m

· Lower than anticipated expenditure:

o Waste disposal costs $0.6m

o Legal services $0.4m

· Higher than anticipated expenditure:

o Storm related damage clean up ($0.3m)

o Kimbriki Waste and Recycling Centre

($0.2m)

|

|

(871)

|

Depreciation

and Amortisation

|

|

|

· Due to the timing of the completion and

capitalisation of new assets.

|

|

(529)

|

Other

Expenses

|

|

· Kimbriki Waste levy ($0.3m)

· Timing of Surf Lifesaving NSW subsidies

($0.1m)

· Delays in project milestones for Mona

Vale Performance Space ($0.1m)

|

|

4,949

|

TOTAL

OPERATING EXPENSES VARIANCE - YTD ACTUALS WITH YTD BUDGET

|

Capital Budget Statement

Capital

expenditure is forecast to increase by $2.1 million to $108.2 million,

primarily due to a new Regional and Local Roads Repair Program grant.

Proposed variations to the capital expenditure budget are

outlined in Attachment 2 ‘Quarterly Budget Review Statement - December

2022’ and include:

· Budget increases in the December 2022 quarterly review include:

o $3.4m Regional and Local roads repair program (grant)

o $1.3m New footpaths program (grant)

o $1.0m Active transport corridor project (grant)

o $0.8m Cromer Depot improvement plan works

· Budgets rephased to future years in the December 2022 quarterly

review include:

o ($2.4m) Active transport corridor project (grant)

Capital

Expenditure Year to Date (YTD) Analysis

Expenditure on capital works for

the six months ended 31 December 2022 is $34.8 million against a year-to-date

budget of $50 million.

Capital budget summary – as at 31 December 2022

($’million)

The principal reasons for the variance in

expenditure versus the year-to-date budget are as follows:

Capital expenditure as at

31 December 2022 – Variance to Approved YTD

Budget

|

YTD Variance $’000

|

Details – Favourable / (Unfavourable) YTD Variance

|

|

6,833

|

Capital

Expenditure – Renewal Projects

|

|

|

· Primarily due to the timing of works

including the road resheeting program $1.5m, footpath renewal programs $1.2m

and planned stormwater renewal works $0.7m.

|

|

8,459

|

Capital

Expenditure – New Projects

|

|

|

· Primarily due to the timing of works

including the new footpaths program $2.2m, Queenscliff headland access ramp

$0.9m and traffic facility works $0.8m.

|

|

15,292

|

TOTAL CAPITAL EXPENDITURE VARIANCE – YTD

ACTUALS WITH YTD BUDGET

|

Further information on the progress of

capital projects is available within Attachment 1 ‘Quarterly Report on

Service Performance’.

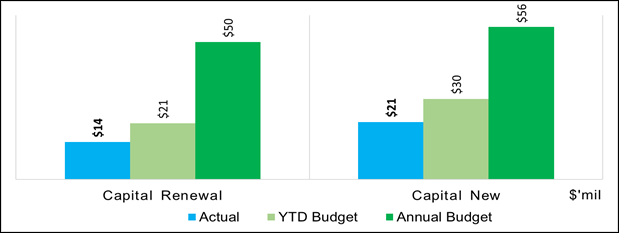

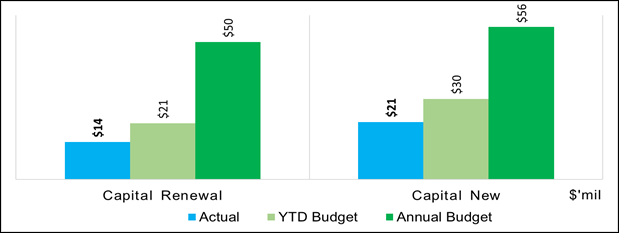

Cash and

Investments

The balance of cash and investments as at

31 December 2022 was $193 million. The revised projected balance on 30 June

2023 is $145 million, $46 million higher than the Original Budget forecast of

$99 million, primarily due to rephasing of capital expenditure to the 2023-2024

financial year and new grants and contributions.

Cash and investments – as at 31 December 2022

Further

information is available on cash and investments within Attachment 2

‘Quarterly Budget Review Statement - December 2022’ to this report.

Financial

Performance Measures

The following financial performance

measures indicate that Council will meet the Office of Local Government’s

benchmarks.

|

|

|

Forecast result

|

Forecast indicator

|

|

Benchmark

|

|

$ '000

|

|

30/6/2023

|

30/6/2023

|

|

|

|

1. Operating Performance

|

|

|

|

|

|

|

Total continuing operating revenue1 excluding capital

grants and contributions less operating expenses

|

|

7,023

|

1.84%

|

✔

|

>0%

|

|

Total continuing operating revenue1 excluding capital

grants and contributions

|

|

381,312

|

|

1. Excludes fair value adjustments,

reversal of revaluation decrements and net gain on sale of assets.

This

ratio measures Council’s achievement of containing operating

expenditure within operating revenue. It is important to distinguish that

this ratio is focusing on operating performance and hence capital grants and

contributions, fair value adjustments, net gain on sale of assets and

reversal of revaluation decrements are excluded.

For the 2022/23 financial year, the

forecast result remains above the benchmark.

|

|

|

|

Forecast result

|

Forecast indicator

|

|

Benchmark

|

|

$ '000

|

|

30/6/2023

|

30/6/2023

|

|

|

|

2. Unrestricted Current Ratio

|

|

|

|

|

|

|

Current assets less all external restrictions

|

|

124,792

|

1.69x

|

✔

|

>1.5x

|

|

Current liabilities less specific purpose liabilities

|

|

73,697

|

|

The

Unrestricted Current Ratio is specific to local government and is designed to

represent a Council’s ability to meet short term obligations as they

fall due. Restrictions placed on various funding sources (e.g., development

contributions and domestic waste income) complicate the traditional current

ratio used to assess liquidity of businesses as cash allocated to specific

projects is restricted and cannot be used to meet a Council’s other

operating and borrowing costs – these funding sources are removed from

this ratio.

For the 2022/23 financial year, the

forecast result will continue to meet the benchmark.

|

CONSULTATION

Where relevant, community feedback on activities or events

is included in the attachment.

TIMING

The Quarterly Budget Review Statement meets the requirements

of the Local Government Act 1993 (s404(5)) and Local Government (General)

Regulation 2021 (S203), namely that Council report quarterly on a budget review

statement, and at least every six months on the principal activities of its

Operational Plan.

LINK TO STRATEGY

This report relates to the Community

Strategic Plan Outcome of:

· Good governance - Goal 19 Our Council is transparent and trusted to

make decisions that reflect the values of the community

financial considerations

The operating surplus (which includes capital grants and

contributions) for the financial year is forecast to increase by $5.8 million

to a surplus of $48.4 million. Excluding capital grants and contributions the

result is forecast to improve by $0.8 million, from a surplus of $6.6 million

to a surplus of $7.4 million. Capital Expenditure is forecast to increase by

$2.1 million to $108.2 million.

Council’s

budget remains balanced and is expected to meet all financial performance

benchmarks this financial year.

social considerations

The report discloses progress on implementing the

Operational Plan 2022/23. This includes the continued

delivery of services and capital works that support our community and economy.

These initiatives will have a positive social and economic impact on the

community, including additional services and support available during natural

hazard events and the COVID-19 pandemic.

environmental considerations

The report provides progress on

implementing the Operational Plan 2022/23 which includes a range of projects to

protect and enhance our natural environment - by managing our coast, bush and

biodiversity; implementing catchment management initiatives; and a variety of

on-ground works and education in our urban and natural settings.

governance and risk

considerations

The Quarterly Budget Review Statement meets

the statutory reporting requirements for progress at the end of the quarter

– i.e., implementation of the Operational Plan 2022/23 and

Council’s overall financial position. It is provided to enable informed

decision making while also ensuring transparency on Council’s governance,

business assurance and financial sustainability.

|

|

Report To Ordinary Council MEETING

|

|

ITEM NO. 9.3 - 28 February 2023

|

pp

|

ITEM 9.3

|

Monthly

Investment Report - November 2022

|

|

REPORTING MANAGER

|

Chief

Financial Officer

|

|

TRIM file

REF

|

2022/776429

|

|

ATTACHMENTS

|

Nil

|

purpose

To provide a report setting out details of all money that

Council has invested under section 625 of the Local Government Act 1993.

executive summary

In accordance with section 212 of the Local Government

(General) Regulation 2021, a report setting out the details of money invested

must be presented to Council on a monthly basis.

The report must also include certification as to whether or

not the investments have been made in accordance with the Act, the Regulations

and Council’s Investment Policy.

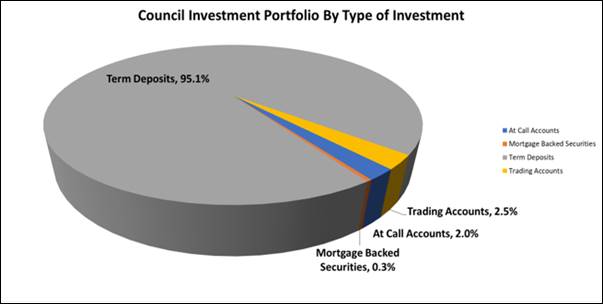

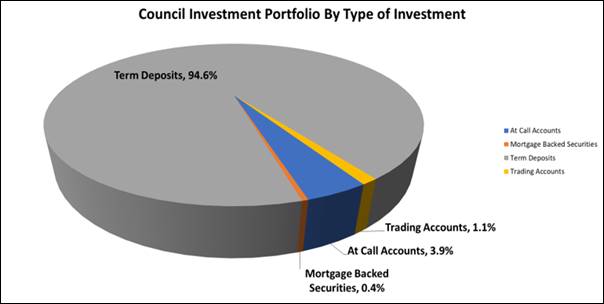

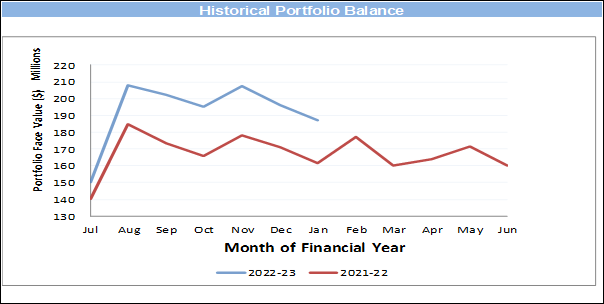

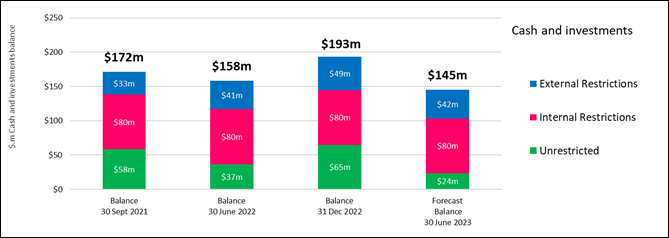

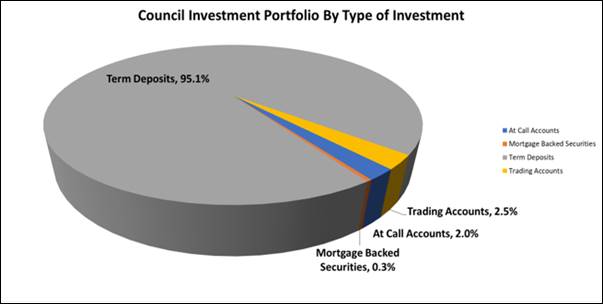

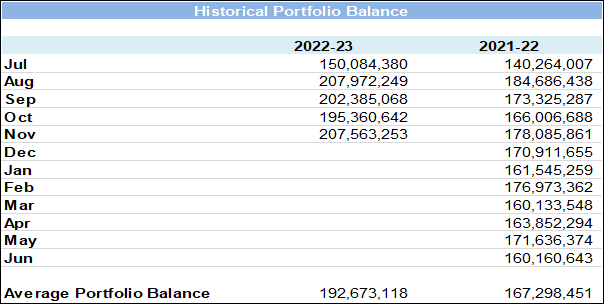

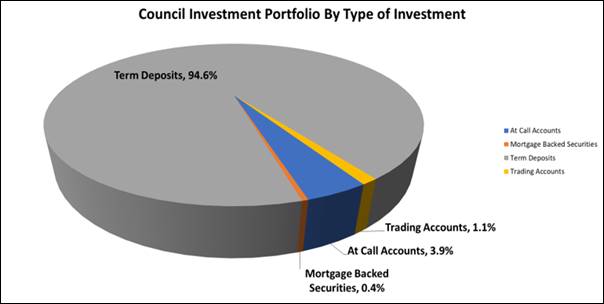

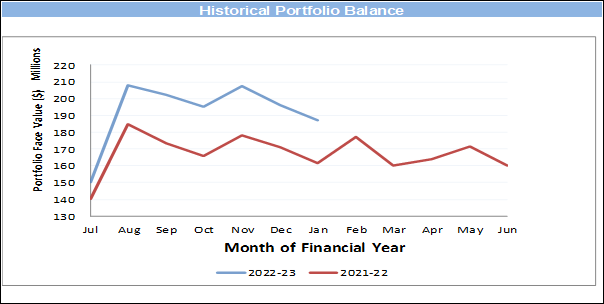

The Investment Report shows that Council has total cash and

investments of $207,563,253 comprising:

|

· Trading Accounts

|

$5,265,995

|

|

· Investments

|

$202,297,258

|

The

portfolio achieved a return of 0.291% for the month of November which was

0.041% above the benchmark AusBond Bank Bill Index return of 0.25%. For the

past 12 months the portfolio achieved a return of 1.472% which was 0.462% above

the benchmark AusBond Bank Bill Index return of 1.01%.

The weighted average interest rate of the portfolio is 3.61%

compared to 3.40% for the prior month. For the past 12 months the weighted

average interest rate of the portfolio was 1.66% compared to the average Ausbond

Bank Bill movement of 0.08% and the average Reserve Bank of Australia Cash Rate

of 1.06%.

Certification –

Responsible Accounting Officer

I hereby certify that the investments listed in the attached

reports have been made in accordance with section 625 of the Local

Government Act 1993, section 212 of the Local Government (General)

Regulation 2021 and existing Investment Policies.

RECOMMENDATION OF Director Corporate and Legal

That Council note the Investment Report as of 30 November

2022, including the certification by the Responsible Accounting Officer.

BACKGROUND

In accordance with section 212 of the Local Government

(General) Regulation 2021, a report setting out the details of money invested

must be presented to Council on a monthly basis.

The report must also include certification as to whether or

not the investments have been made in accordance with the Act, the Regulations

and Council’s Investment Policy.

LINK TO STRATEGY

This report relates to the Community Strategic Plan Outcome

of:

· Good

governance - Goal 19 Our Council is transparent and trusted to make decisions

that reflect the values of the community

financial considerations

Actual investment income for the period from 1 July 2022 to

date was $2,176,095 compared to budgeted income of $249,700, a positive

variance of $1,926,395.

social considerations

Council’s investments are managed in accordance with

Council’s Investment Policy. Council’s Investment Policy requires

consideration of social responsibility when making investment decisions.

environmental considerations

Council’s investments are managed in accordance with

Council’s Investment Policy. Council’s Investment Policy requires

consideration of environmental responsibility when making investment decisions.

governance and risk

considerations

A revised Investment Policy was adopted by Council at its

meeting on 26 July 2022. The Policy is reviewed annually by the Audit, Risk and

Improvement Committee. It was reviewed by the Committee at their meeting in

December 2022, and no changes to the Policy were proposed, with the next review

by the Committee due by December 2023.

Council’s Investment Strategy

was reviewed in November 2022 by Council’s Investment Advisors, Laminar

Capital Pty Ltd, who confirmed that the current policy “remains

consistent with the Ministerial Investment Order and guidelines issued by the

Chief Executive (Local Government), Department of Premier and Cabinet”

and that they “do not recommend any changes to the list of approved

investments or credit limit frameworks”.

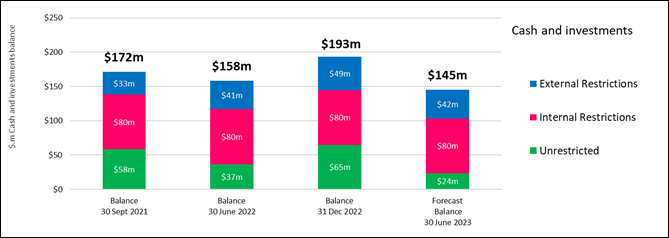

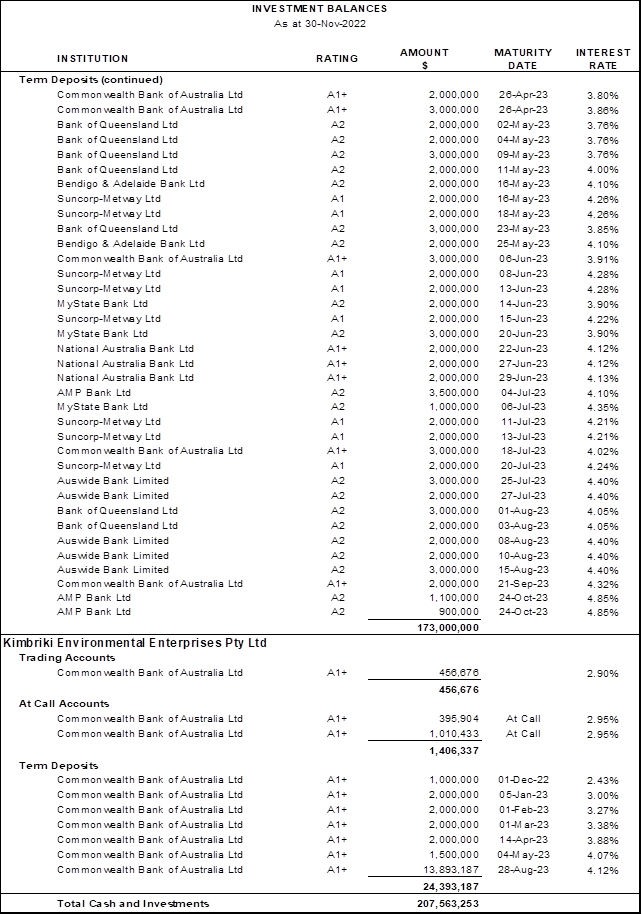

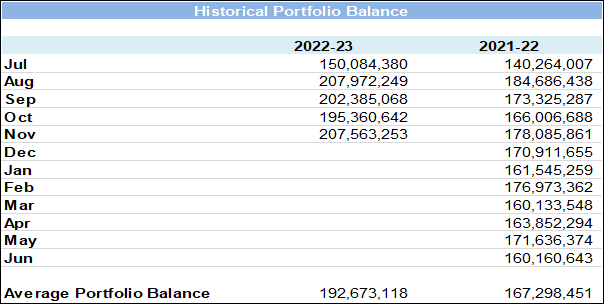

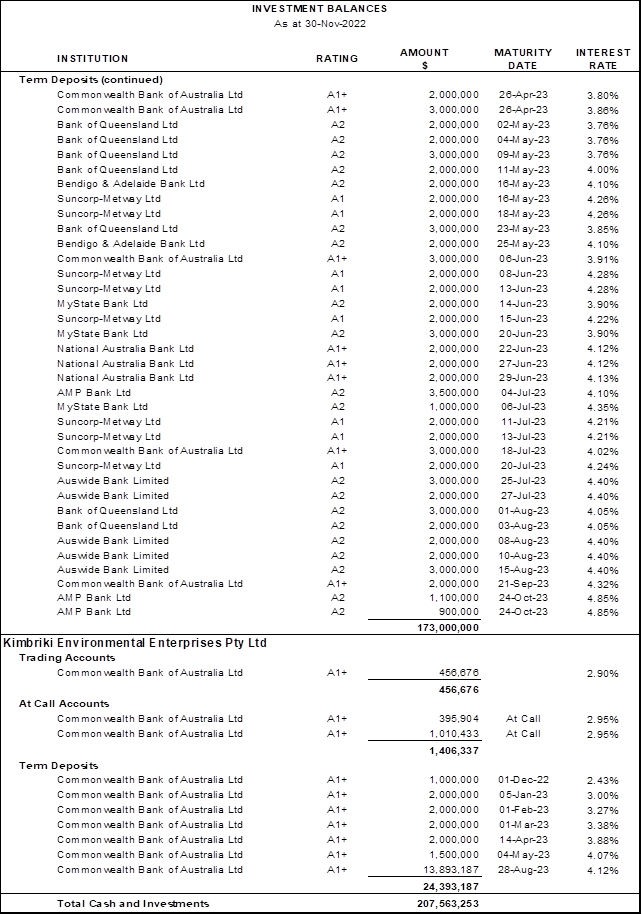

Investment Balances

*Rating is based on

a private rating advised by the issuer to Council’s Investment Advisors.

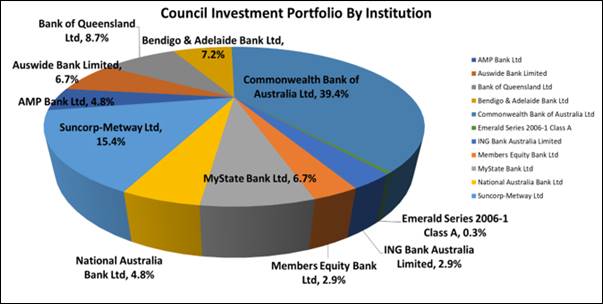

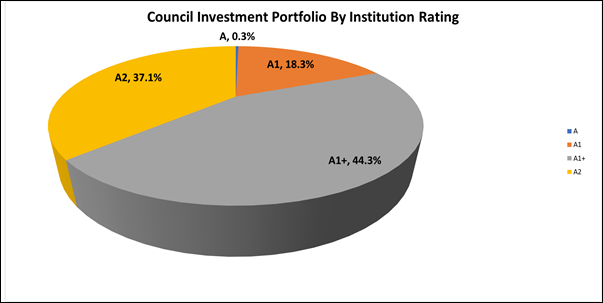

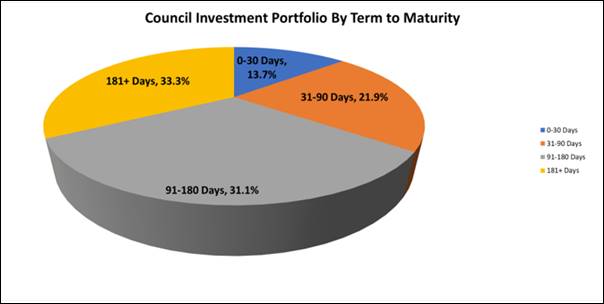

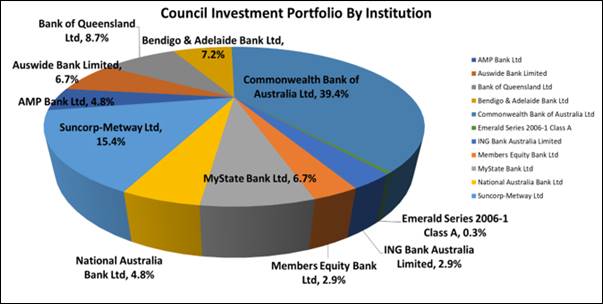

Portfolio Analysis

Institutional Credit Framework – Compliance with Investment

Policy Requirements

Clause 4.2.2 of Council’s Investment Policy requires

that the exposure to an individual institution be restricted by their credit

rating so that single entity exposure is limited, as detailed in the table

below:

|

S&P

Long Term Rating*

|

S&P

Short Term Rating*

|

Maximum %

|

Portfolio

Complies with Policy?

|

|

AAA

(incl. government guaranteed

deposits)

|

A-1+

|

50%

|

Yes

|

|

AA+

|

|

AA

|

|

AA-

|

|

A+

|

A-1

|

40%

|

Yes

|

|

A

|

|

A-

|

A-2

|

30%

|

Yes

|

|

BBB+

|

|

BBB

|

|

BBB-

|

A-3

|

10%

|

Yes

|

|

Unrated**TCorp Funds

|

Unrated**

|

5%

|

Yes ($Nil)

|

|

Unrated***ADIs

|

Unrated***

|

$250,000

|

Yes ($Nil)

|

* Or Moody’s / Fitch equivalents

** Unrated

Category is restricted to eligible managed funds such as the NSW Treasury

Corporation Hour Glass Facilities

*** Unrated

ADIs Category is restricted to those ADIs that are under the Australian

government guarantee scheme and limited to maximum $250,000 per unrated ADI.

As Members Equity Bank is a fully owned subsidiary of Bank

of Queensland, the holdings are combined to determine the maximum percentage

which can be held under clause 4.2.2 (Institutional Credit Framework Guidelines)

of Council’s Investment Policy.

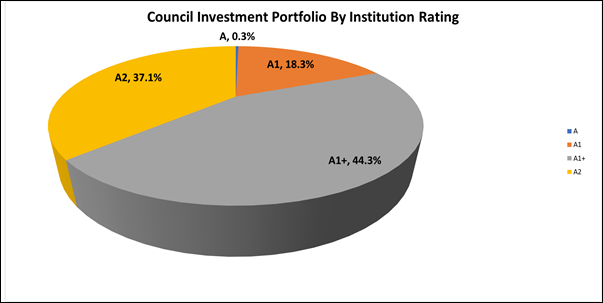

Overall Portfolio Credit Framework – Compliance with Investment

Policy Requirements

Clause 4.2.1 of Council’s Investment Policy requires

that the total percentage exposure within the market to any particular credit

rating category be limited, as detailed in the table below:

|

S&P

Long Term Rating*

|

S&P

Short Term Rating*

|

Maximum %

|

Portfolio

Complies with Policy?

|

|

AAA

(incl. government

guaranteed deposits)

|

A-1+

|

100%

|

Yes

|

|

AA+

|

|

AA

|

|

AA-

|

|

A+

|

A-1

|

100%

|

Yes

|

|

A

|

|

A-

|

A-2

|

80%

|

Yes

|

|

BBB+

|

|

BBB

|

|

BBB-

|

A-3

|

30%

|

Yes

|

|

Unrated**

|

Unrated**

|

5%

|

Yes ($Nil)

|

* Or Moody’s / Fitch equivalents

** Unrated

Category is restricted to eligible managed funds such as the NSW Treasury

Corporation Hour Glass Facilities and ADIs covered by the government guarantee

scheme.

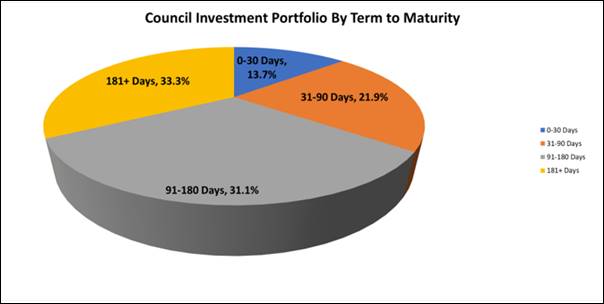

Term to Maturity Framework

– Compliance with Investment Policy Requirements

Clause 4.2.4 of Council’s Investment Policy requires

Council’s investment portfolio is to be invested within the following

maturity constraints:

|

Overall Portfolio Term to Maturity

Limits

|

Portfolio Complies with Policy?

|

|

Portfolio

% <1 year

|

Min 40%

|

Max 100%

|

Yes

|

|

Portfolio

% >1 year ≤3 year

|

Min 0%

|

Max 60%

|

Yes

|

|

Portfolio

% >3 year ≤5 year

|

Min 0%

|

Max 30%

|

Yes

|

Investment

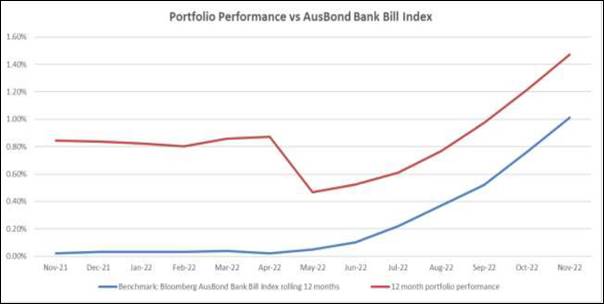

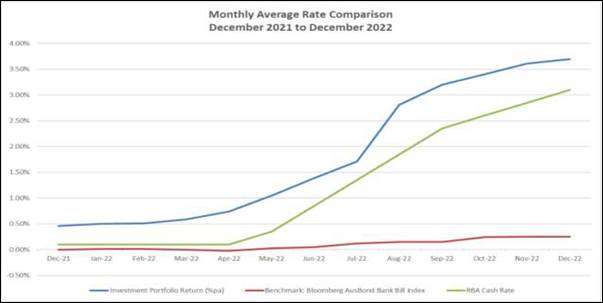

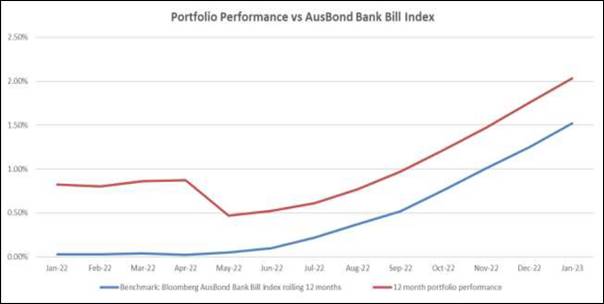

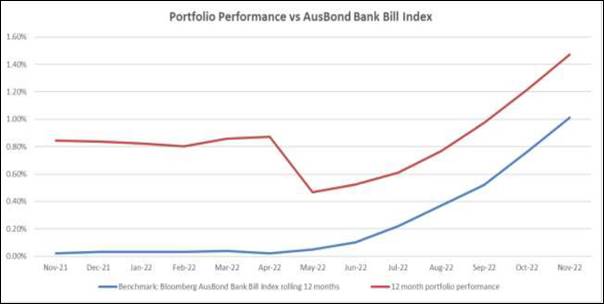

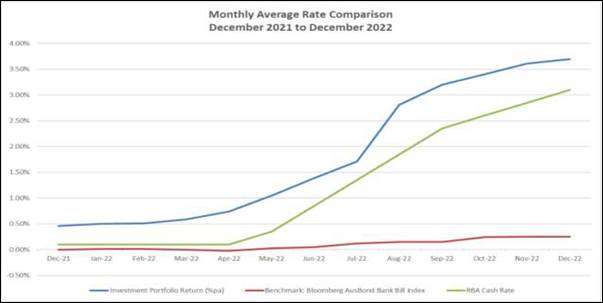

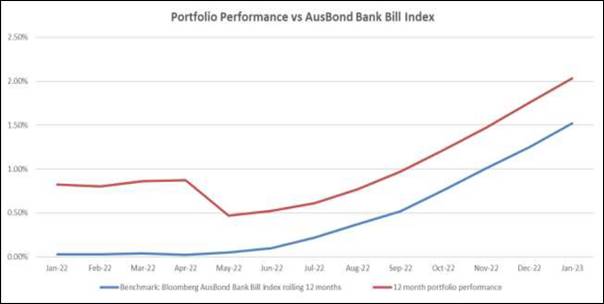

Performance vs Benchmark

a) Portfolio

Return vs Benchmark

|

|

Investment Portfolio Return *

|

Benchmark: AusBond Bank Bill

Index

|

|

1 month

|

0.291%

|

0.25%

|

|

3 Months

|

0.798%

|

0.64%

|

|

FYTD

|

1.106%

|

0.92%

|

|

12 Months

|

1.472%

|

1.01%

|

* Excludes trading account balances

Council’s Investment Advisors have stated this

form of portfolio reporting conforms to global investment performance standards

and that these standards say that periods below 12 months should not be

annualised

The above table shows a

comparison of Council’s investment portfolio return to the benchmark.

Council’s Investment Advisor, Laminar Capital, has created an

accumulation index for the portfolio which increases each month by the

portfolio internal rate of return to enable meaningful comparison to the benchmark

AusBond Bank Bill index, which is an accumulation index.

The Bloomberg AusBond Bank Bill

Index is engineered to measure the Australian money market by representing a

passively managed short term money market portfolio. This index is comprised of

13 synthetic instruments defined by rates interpolated from the RBA 24-hour

cash rate, 1M BBSW, and 3M BBSW.

The

portfolio achieved a return of 0.291% for the month of November which was

0.041% above the benchmark AusBond Bank Bill Index return of 0.25%. For the

past 12 months the portfolio achieved a return of 1.472% which was 0.462% above

the benchmark AusBond Bank Bill Index return of 1.01%.

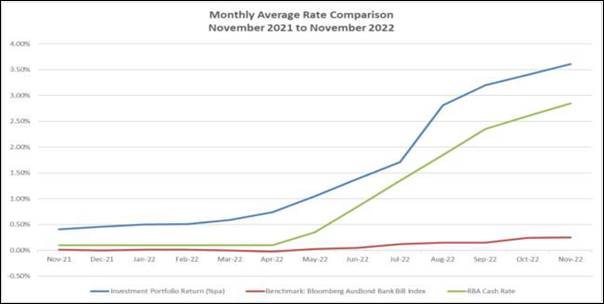

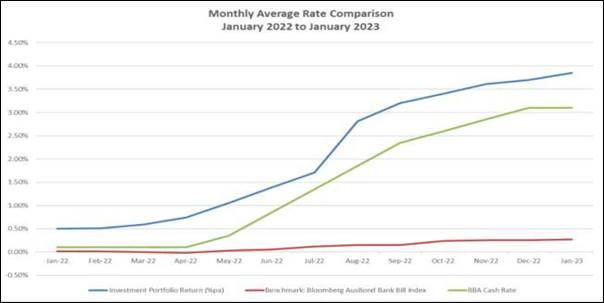

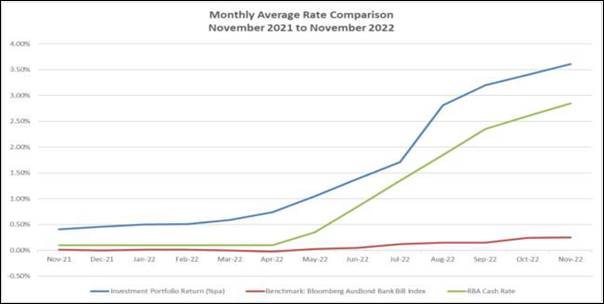

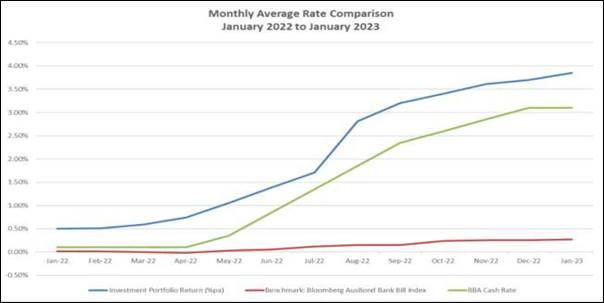

b) Portfolio

Interest Rate vs Benchmarks

|

|

Weighted Average Portfolio

Interest Rate (%pa) *

|

Average Benchmark: AusBond

Bank Bill Index

|

Average

RBA Cash Rate

|

|

1 month

|

3.61%

|

0.25%

|

2.85%

|

|

3 Months

|

3.40%

|

0.21%

|

2.60%

|

|

6 Months

|

2.69%

|

0.16%

|

1.98%

|

|

FYTD

|

2.95%

|

0.18%

|

2.20%

|

|

12 Months

|

1.66%

|

0.08%

|

1.06%

|

* Excludes trading account balances

The above table shows the weighted average interest rate of the portfolio as

at month end. This is an average of all the interest rates that each term

deposit is earning. It is the current earning rate of the portfolio and this

information is useful as it shows how the earning rate is changing each month

in line with changes in market interest rates. Each time a term deposit matures

during the month it is being reinvested at current interest rates. To

facilitate meaningful comparison, the weighted average interest rate of the

portfolio is compared to the average AusBond Bank Bill Index and average RBA

Cash Rate for the same period.

The weighted average interest rate of the portfolio is

3.61% compared to 3.40% for the prior month. For the past 12 months the weighted

average interest rate of the portfolio was 1.66% compared to the average

Ausbond Bank Bill movement of 0.08% and the average Reserve bank of Australia

Cash Rate of 1.06%.

Monthly Investment Income* vs Budget

|

|

November 2022

$

|

Year to Date

$

|

|

Investment Income

|

567,528

|

2,164,474

|

|

Adjustment for Fair Value

|

9,375

|

11,621

|

|

Total Investment Income

|

576,903

|

2,176,095

|

|

|

|

|

|

Budgeted Income

|

57,100

|

249,700

|

*Includes

all cash and investment holdings

Statement of Compliance

|

Portfolio

Performance vs Bank Bill Index over 12-month period.

|

✔

|

Council’s

investment performance did exceed benchmark.

|

|

Monthly

Income vs Budget

|

✔

|

Council’s

income from investments did exceed monthly budget.

|

|

Investment

Policy Compliance

|

|

|

|

Legislative

Requirements

|

✔

|

Fully

compliant

|

|

Portfolio

Credit Rating Limit

|

✔

|

Fully

compliant

|

|

Institutional

Exposure Limits

|

✔

|

Fully

compliant

|

|

Term

to Maturity Limits

|

✔

|

Fully

compliant

|

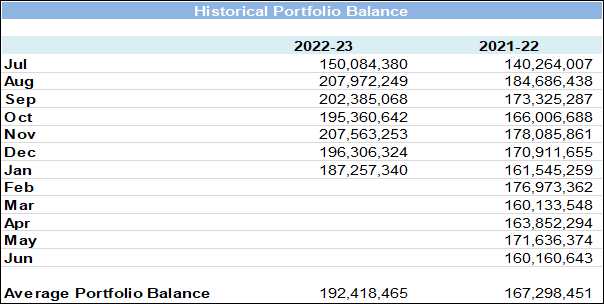

Restricted

cash, cash equivalents and investments

The breakdown of restrictions is not available for the

current month within the timeframe for the completion of the Monthly

Investment. Accordingly, the total cash and investments and restrictions

related thereto are presented for the previous month.

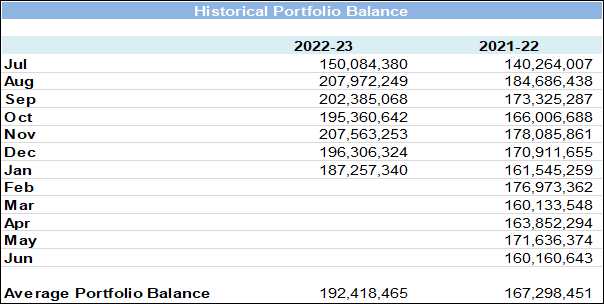

At the end

of October 2022 total cash & investments were $195,360,642 and were made up

of the following reserve allocations.

|

Allocation of Funds

|

Amount ($)

|

Percentage

|

|

Externally Restricted

|

48,158,636

|

24.65%

|

|

Internally Restricted

|

80,186,843

|

41.05%

|

|

Total Restricted

|

128,345,479

|

65.70%

|

|

Unrestricted

|

67,015,163

|

34.30%

|

|

Total

|

$195,360,642

|

100.00%

|

ECONOMIC

NOTES

(Source: Primarily extracted from information supplied by

Laminar Capital Pty Ltd)

Most leading economic

indicators and rising central banks’ official interest rates point

towards global recession, but the latest household spending and labour market

data in the US, Europe and Australia are still showing resilience. Annual

inflation readings showed more signs of topping out in November in the US and

Europe while Australia seems to be closing in on peak annual inflation. Central

banks are starting to talk about hiking official interest rates in smaller

increments although most still announced large hikes in November. The path

still looks a long one towards returning annual inflation to central

banks’ targets indicating that once official interest rates peak, the

stay at the peak may be longer than it has been in the past – around

three months on average for the US.

In the US, leading

economic indicators weakened further in November. Housing indicators were weak

mostly. The November National Association of Homebuilders’ index fell to

a cycle low 33 from 38 in October, a far cry from the 70+ readings a year ago.

October building permits, housing starts, and existing home sales fell

respectively m-o-m by 2.4%; 4.2%; and 5.9%. Exceptions to the weakness in the

housing figures were September pending home sales, up 0.8% m-o-m and October

new home sales, up 7.5%. The October ISM purchasing managers’ reports for

the manufacturing and non-manufacturing sectors slipped to respectively 50.2

(September 50.9) and 54.4 (September 56.7). The November readings out in early

December are likely to see at least one slip below the 50 expansion/contraction

line, although readings in the low-to-mid 40s in the past have been harbingers

of recession.

In China, economic data

released in November remained weak beset by the continuing downturn in the

property sector, the lockdowns used to control Omicron outbreaks, and softening

global demand for China’s exports. October exports and imports were both

weaker than expected. October fixed asset investment spending moderated to

+5.8% y-o-y from +5.9% in September and October industrial production to +5.2%

y-o-y from +6.3% y-o-y in September. The greatest damage from sporadic and

unpredictable covid-containment lockdowns showed in retail sales, 0.5% y-o-y in

October from +2.5% y-o-y in September. Rare signs of opposition to President Xi

and his policies showed in civil protests in some cities. China’s

economic growth rate will continue to languish while current lockdown policies persist.

An ill wind on the economic growth front is delivering inflation that is very

low by international standards.

Europe continues to

teeter on the edge of recession but is not quite there yet. A milder than usual

autumn so far in Western Europe is providing hope that energy supply shortages

and price hikes may not be as great as widely feared in the approaching winter.

European Q3 GDP growth lifted 0.2% q-o-q, 2.1% y-o-y. Leading European economic

indicators point towards recession with the November manufacturing and service

sectors PMIs at respectively, 47.3 and 48.6. September retail sales rose 0.3%

m-o-m and the unemployment rate is still hugging the cycle low point at 6.6%.

CPI inflation at 10.6% y-o-y in October was probably at its peak for this cycle

but is unlikely to recede fast given that producer prices are up over 40%

y-o-y. The ECB is indicating that fighting high inflation is the key policy

aim, even at the risk of adding to the risk of recession. In the UK, where

economic growth has turned negative, the Bank of England has no choice but to

continue hiking interest rates to contain double-digit annual inflation.

Australia is an example

of the split between soft leading economic indicators and surprisingly strong

coincident and lagging indicators threatening to keep inflation too high for

too long. Housing activity at the leading edge continued to weaken in November

under pressure from higher borrowing interest rates. House prices are falling

at the fastest pace in 40 years. In September, the value of housing finance

commitments was down by 8.2% m-o-m and down by 18.5% y-o-y. September home

building approvals were down by 5.8% m-o-m and were down by 13.0% y-o-y. As

more fixed-rate home loans written in 2020 and 2021 come up for renewal over coming

months and the RBA hikes the cash rate at least two more times, housing

activity looks set to weaken further.

|

|

Report To Ordinary Council MEETING

|

|

ITEM NO. 9.4 - 28 February 2023

|

pp

|

ITEM 9.4

|

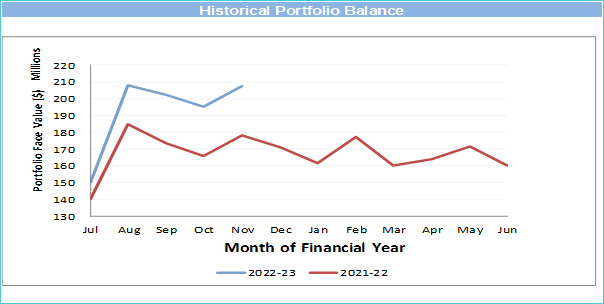

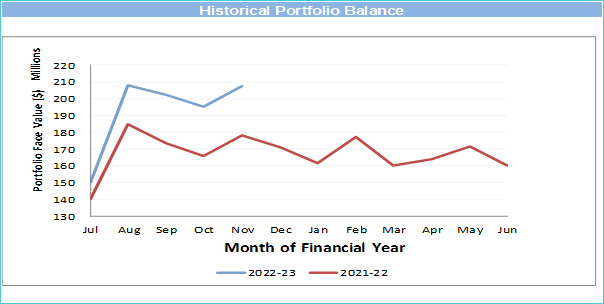

Monthly

Investment Report - December 2022

|

|

REPORTING MANAGER

|

Chief

Financial Officer

|

|

TRIM file

REF

|

2023/009842

|

|

ATTACHMENTS

|

Nil

|

purpose

To provide a report setting out details of all money that

Council has invested under section 625 of the Local Government Act 1993.

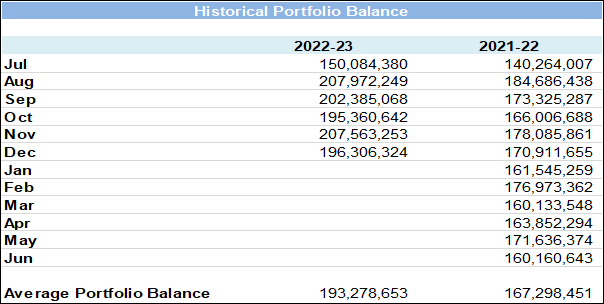

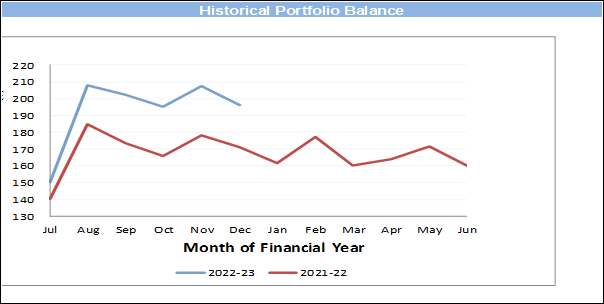

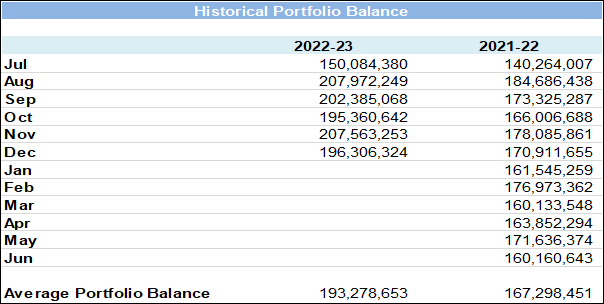

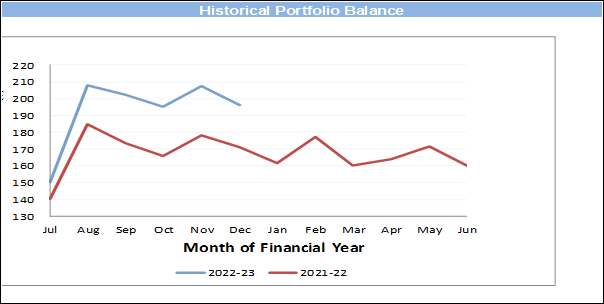

executive summary

In accordance with section 212 of the Local Government

(General) Regulation 2021, a report setting out the details of money invested

must be presented to Council on a monthly basis.

The report must also include certification as to whether or

not the investments have been made in accordance with the Act, the Regulations

and Council’s Investment Policy.

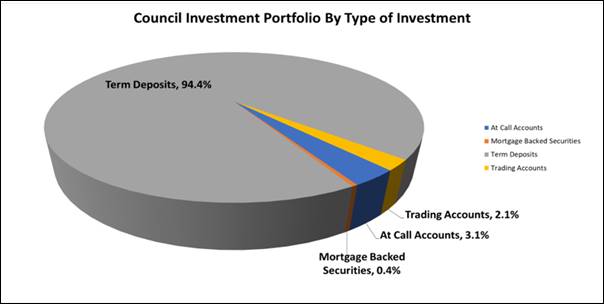

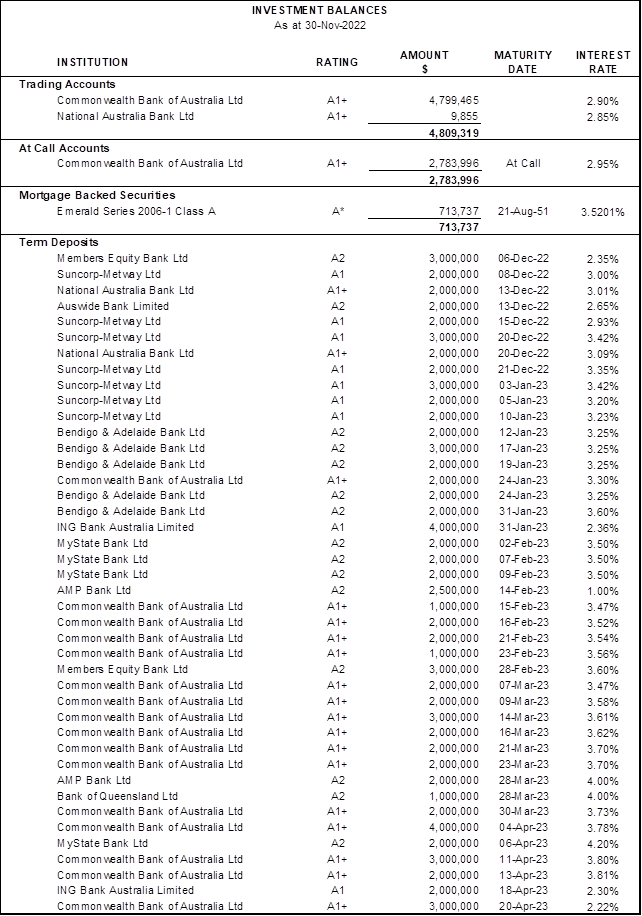

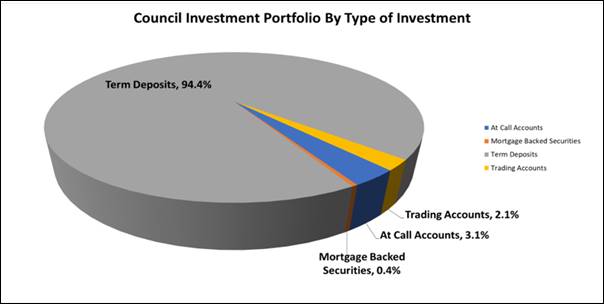

The Investment Report shows that Council has total cash and

investments of $196,306,324 comprising:

|

· Trading Accounts

|

$4,030,625

|

|

· Investments

|

$192,275,699

|

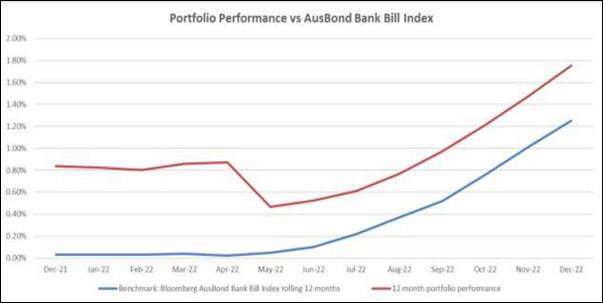

The portfolio achieved a return of

0.311% for the month of November which was 0.061% above the benchmark AusBond

Bank Bill Index return of 0.25%. For the past 12 months the portfolio achieved

a return of 1.754% which was 0.504% above the benchmark AusBond Bank Bill Index

return of 1.25%.

The weighted average interest rate of the portfolio is 3.70%

compared to 3.61% for the prior month. For the past 12 months the weighted

average interest rate of the portfolio was 1.93% compared to the average Ausbond

Bank Bill movement of 0.10% and the average Reserve Bank of Australia Cash Rate

of 1.31%.

Certification –

Responsible Accounting Officer

I hereby certify that the investments listed in the attached

reports have been made in accordance with section 625 of the Local

Government Act 1993, section 212 of the Local Government (General)

Regulation 2021 and existing Investment Policies.

RECOMMENDATION OF Director Corporate and Legal

That Council note the Investment Report as at 31 December

2022, including the certification by the Responsible Accounting Officer.

BACKGROUND

In accordance with section 212 of the Local Government

(General) Regulation 2021, a report setting out the details of money invested

must be presented to Council on a monthly basis.

The report must also include certification as to whether or

not the investments have been made in accordance with the Act, the Regulations

and Council’s Investment Policy.

LINK TO STRATEGY

This report relates to the Community Strategic Plan Outcome

of:

· Good

governance - Goal 19 Our Council is transparent and trusted to make decisions

that reflect the values of the community

financial considerations

Actual investment income for the period from 1 July 2022 to

date was $2,807,131 compared to budgeted income of $307,400, a positive

variance of $2,499,731.

social considerations

Council’s investments are managed in accordance with

Council’s Investment Policy. Council’s Investment Policy requires

consideration of social responsibility when making investment decisions.

environmental considerations

Council’s investments are managed in accordance with

Council’s Investment Policy. Council’s Investment Policy requires

consideration of environmental responsibility when making investment decisions.

governance and risk

considerations

A revised Investment Policy was adopted by Council at its meeting

on 26 July 2022. The Policy is reviewed annually by the Audit, Risk and

Improvement Committee. It was reviewed by the Committee at their meeting in

December 2022, and no changes to the Policy were proposed, with the next review

by the Committee due by December 2023.

Council’s Investment Strategy was reviewed in November

2022 by Council’s Investment Advisors, Laminar Capital Pty Ltd, who

confirmed that the current policy “remains consistent with the

Ministerial Investment Order and guidelines issued by the Chief Executive

(Local Government), Department of Premier and Cabinet” and that they

“do not recommend any changes to the list of approved investments or

credit limit frameworks”.

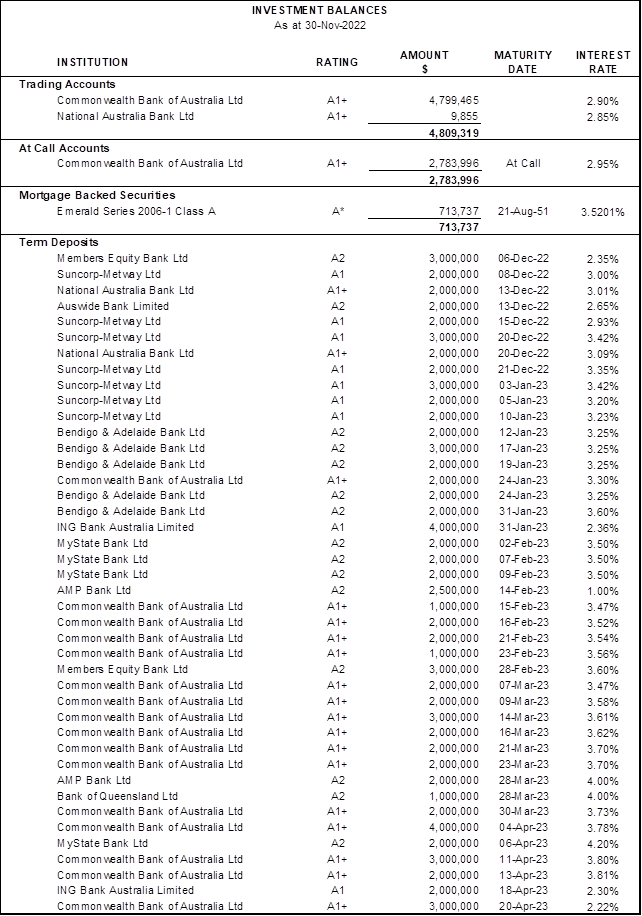

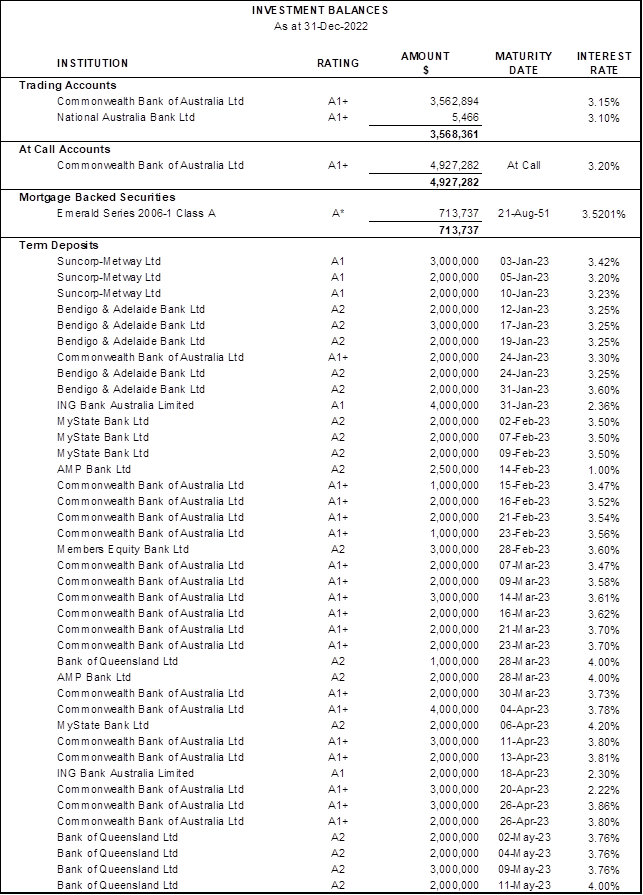

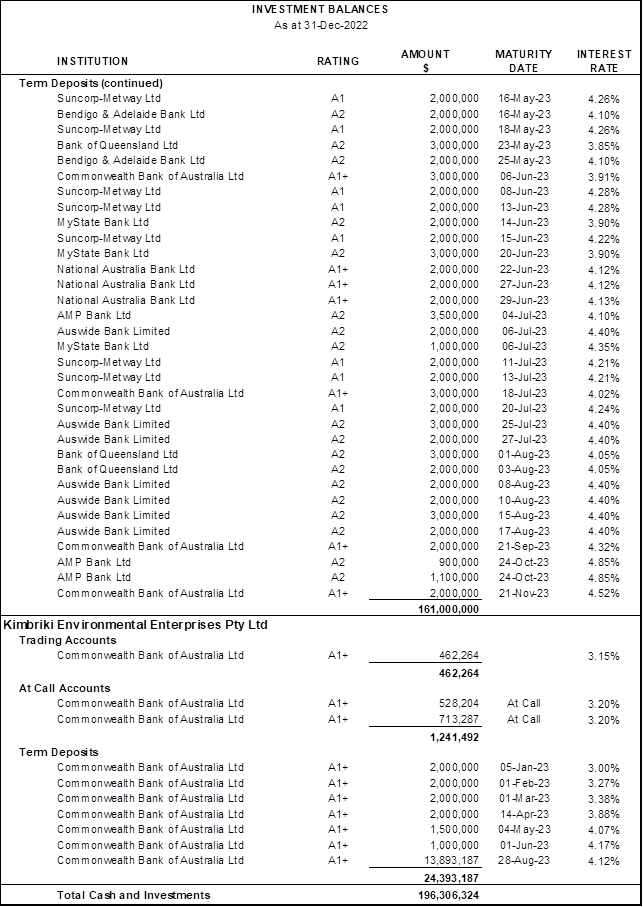

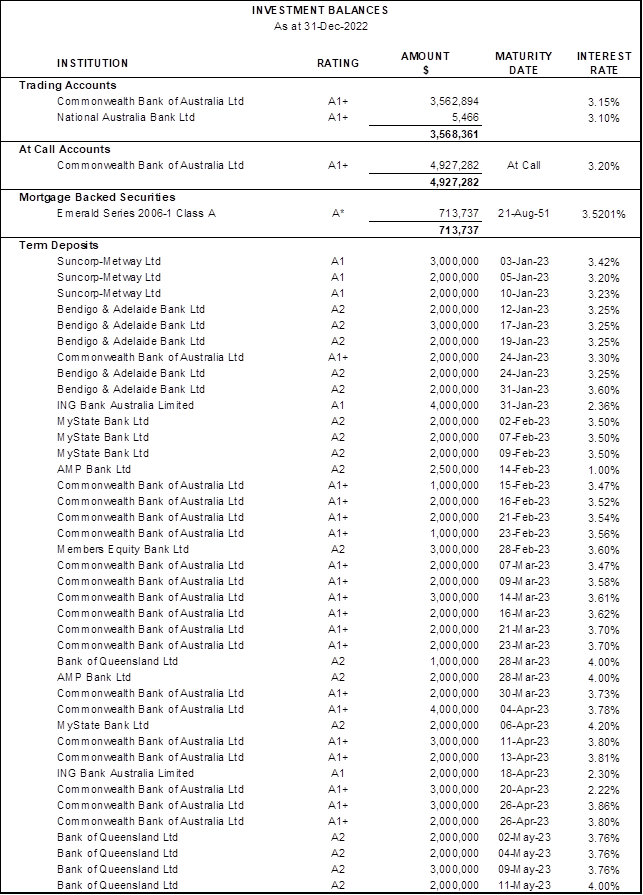

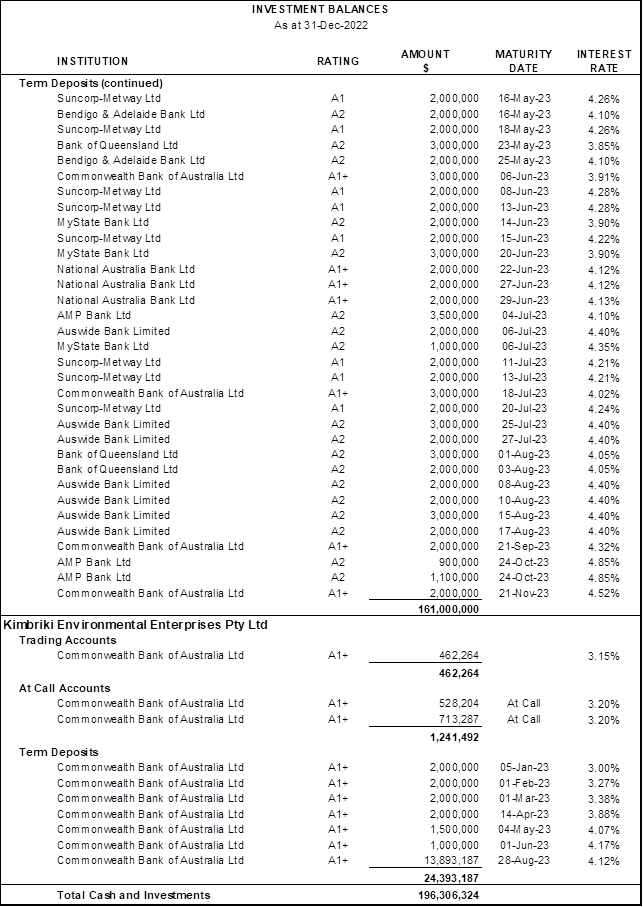

Investment Balances

*Rating is based on

a private rating advised by the issuer to Council’s Investment Advisors.

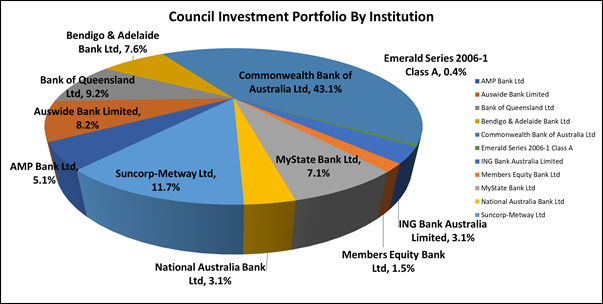

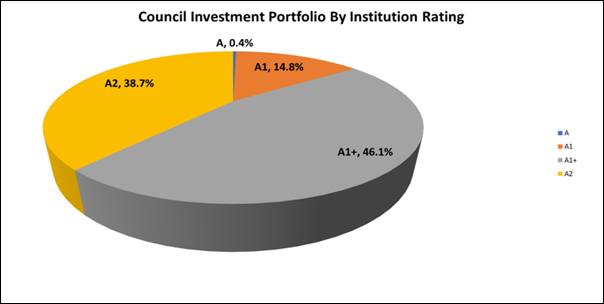

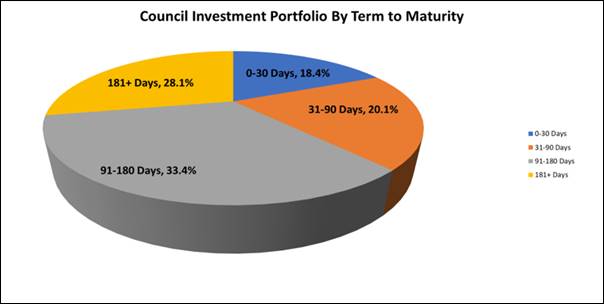

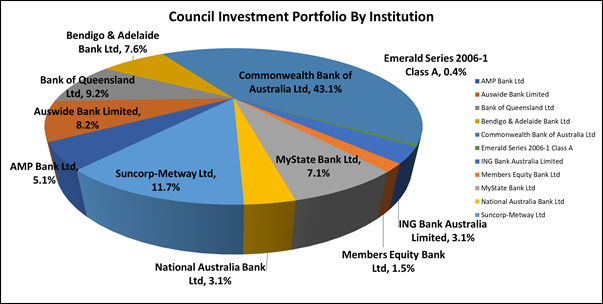

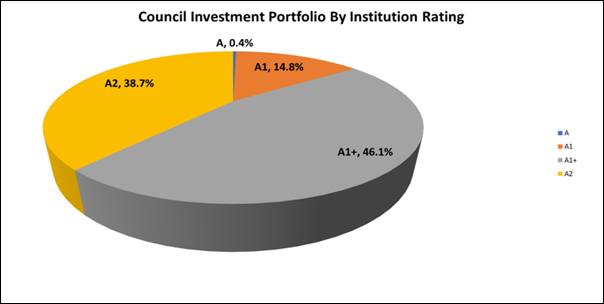

Portfolio

Analysis

Institutional Credit Framework – Compliance with Investment

Policy Requirements

Clause 4.2.2 of Council’s Investment Policy requires

that the exposure to an individual institution be restricted by their credit

rating so that single entity exposure is limited, as detailed in the table

below:

|

S&P

Long Term Rating*

|

S&P

Short Term Rating*

|

Maximum %

|

Portfolio

Complies with Policy?

|

|

AAA

(incl. government

guaranteed deposits)

|

A-1+

|

50%

|

Yes

|

|

AA+

|

|

AA

|

|

AA-

|

|

A+

|

A-1

|

40%

|

Yes

|

|

A

|

|

A-

|

A-2

|

30%

|

Yes

|

|

BBB+

|

|

BBB

|

|

BBB-

|

A-3

|

10%

|

Yes

|

|

Unrated**TCorp Funds

|

Unrated**

|

5%

|

Yes ($Nil)

|

|

Unrated***ADIs

|

Unrated***

|

$250,000

|

Yes ($Nil)

|

* Or Moody’s / Fitch equivalents

** Unrated

Category is restricted to eligible managed funds such as the NSW Treasury

Corporation Hour Glass Facilities

*** Unrated

ADIs Category is restricted to those ADIs that are under the Australian

government guarantee scheme and limited to maximum $250,000 per unrated ADI.

As Members Equity Bank is a fully owned subsidiary of Bank

of Queensland, the holdings are combined to determine the maximum percentage

which can be held under clause 4.2.2 (Institutional Credit Framework

Guidelines) of Council’s Investment Policy.

Overall Portfolio Credit Framework – Compliance with Investment

Policy Requirements

Clause 4.2.1 of Council’s Investment Policy requires

that the total percentage exposure within the market to any particular credit

rating category be limited, as detailed in the table below:

|

S&P

Long Term Rating*

|

S&P

Short Term Rating*

|

Maximum %

|

Portfolio

Complies with Policy?

|

|

AAA

(incl. government

guaranteed deposits)

|

A-1+

|

100%

|

Yes

|

|

AA+

|

|

AA

|

|

AA-

|

|

A+

|

A-1

|

100%

|

Yes

|

|

A

|

|

A-

|

A-2

|

80%

|

Yes

|

|

BBB+

|

|

BBB

|

|

BBB-

|

A-3

|

30%

|

Yes

|

|

Unrated**

|

Unrated**

|

5%

|

Yes ($Nil)

|

* Or Moody’s / Fitch equivalents

** Unrated

Category is restricted to eligible managed funds such as the NSW Treasury

Corporation Hour Glass Facilities and ADIs covered by the government guarantee

scheme.

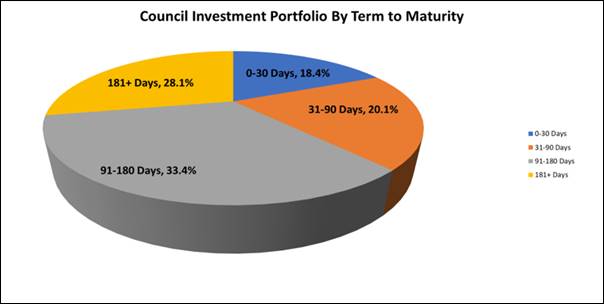

Term to Maturity Framework

– Compliance with Investment Policy Requirements

Clause 4.2.4 of Council’s Investment Policy requires

Council’s investment portfolio is to be invested within the following

maturity constraints:

|

Overall Portfolio Term to Maturity

Limits

|

Portfolio Complies with Policy?

|

|

Portfolio

% <1 year

|

Min 40%

|

Max 100%

|

Yes

|

|

Portfolio

% >1 year ≤3 year

|

Min 0%

|

Max 60%

|

Yes

|

|

Portfolio

% >3 year ≤5 year

|

Min 0%

|

Max 30%

|

Yes

|

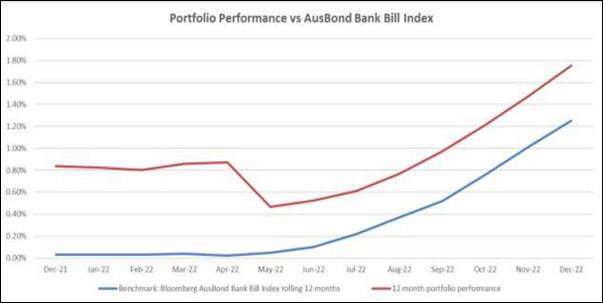

Investment

Performance vs Benchmark

a) Portfolio

Return vs Benchmark

|

|

Investment Portfolio Return *

|

Benchmark: AusBond Bank Bill

Index

|

|

1 month

|

0.311%

|

0.25%

|

|

3 Months

|

0.875%

|

0.74%

|

|

FYTD

|

1.419%

|

1.17%

|

|

12 Months

|

1.754%

|

1.25%

|

* Excludes trading account balances

Council’s Investment Advisors have stated this

form of portfolio reporting conforms to global investment performance standards

and that these standards say that periods below 12 months should not be

annualised

The above table shows a

comparison of Council’s investment portfolio return to the benchmark.

Council’s Investment Advisor, Laminar Capital, has created an

accumulation index for the portfolio which increases each month by the

portfolio internal rate of return to enable meaningful comparison to the benchmark

AusBond Bank Bill index, which is an accumulation index.

The Bloomberg AusBond Bank Bill

Index is engineered to measure the Australian money market by representing a

passively managed short term money market portfolio. This index is comprised of

13 synthetic instruments defined by rates interpolated from the RBA 24-hour

cash rate, 1M BBSW, and 3M BBSW.

The portfolio achieved a return

of 0.311% for the month of December which was 0.061% above the benchmark

AusBond Bank Bill Index return of 0.25%. For the past 12 months the portfolio

achieved a return of 1.754% which was 0.504% above the benchmark AusBond Bank

Bill Index return of 1.25%.

b) Portfolio

Interest Rate vs Benchmarks

|

|

Weighted Average Portfolio

Interest Rate (%pa) *

|

Average Benchmark: AusBond

Bank Bill Index

|

Average

RBA Cash Rate

|

|

1 month

|

3.70%

|

0.25%

|

3.10%

|

|

3 Months

|

3.57%

|

0.25%

|

2.85%

|

|

6 Months

|

3.07%

|

0.19%

|

2.35%

|

|

FYTD

|

3.07%

|

0.19%

|

2.35%

|

|

12 Months

|

1.93%

|

0.10%

|

1.31%

|

* Excludes trading account balances

The above table shows the

weighted average interest rate of the portfolio as at month end. This is an

average of all the interest rates that each term deposit is earning. It is the

current earning rate of the portfolio and this information is useful as it shows

how the earning rate is changing each month in line with changes in market

interest rates. Each time a term deposit matures during the month it is being

reinvested at current interest rates. To facilitate meaningful comparison, the

weighted average interest rate of the portfolio is compared to the average

AusBond Bank Bill Index and average RBA Cash Rate for the same period.

The weighted average interest rate of the portfolio is

3.70% compared to 3.61% for the prior month. For the past 12 months the weighted

average interest rate of the portfolio was 1.93% compared to the average

Ausbond Bank Bill movement of 0.10% and the average Reserve bank of Australia

Cash Rate of 1.31%.

Monthly Investment Income* vs Budget

|

|

December 2022

$

|

Year to Date

$

|

|

Investment Income

|

631,036

|

2,795,510

|

|

Adjustment for Fair Value

|

0

|

11,621

|

|

Total Investment Income

|

631,036

|

2,807,131

|

|

|

|

|

|

Budgeted Income

|

57,700

|

307,400

|

*Includes

all cash and investment holdings

Statement of Compliance

|

Portfolio

Performance vs Bank Bill Index over 12-month period.

|

✔

|

Council’s

investment performance did exceed benchmark.

|

|

Monthly

Income vs Budget

|

✔

|

Council’s

income from investments did exceed monthly budget.

|

|

Investment

Policy Compliance

|

|

|

|

Legislative

Requirements

|

✔

|

Fully

compliant

|

|

Portfolio

Credit Rating Limit

|

✔

|

Fully

compliant

|

|

Institutional

Exposure Limits

|

✔

|

Fully

compliant

|

|

Term

to Maturity Limits

|

✔

|

Fully

compliant

|

Restricted

cash, cash equivalents and investments

The

breakdown of restrictions is not available for the current month within the

timeframe for the completion of the Monthly Investment. Accordingly, the total

cash and investments and restrictions related thereto are presented for the

previous month.

At the end

of November 2022 total cash & investments were $207,563,253 and were made

up of the following reserve allocations.

|

Allocation of Funds

|

Amount ($)

|

Percentage

|

|

Externally Restricted

|

48,758,318

|

23.49%

|

|

Internally Restricted

|

78,254,839

|

37.70%

|

|

Total Restricted

|

127,013,157

|

61.19%

|

|

Unrestricted

|

80,550,096

|

38.81%

|

|

Total

|

$207,563,253

|

100.00%

|

ECONOMIC

NOTES

(Source: Primarily extracted from information supplied by

Laminar Capital Pty Ltd)

Bond, credit and share

markets fell in December amid concerns that central banks may need to underpin

higher interest rates for longer to return inflation to their targets. A longer

period of higher interest rates would increase the already high risk of a

global recession developing through 2023. The first week of 2023 has seen

markets take an optimistic turn driven by hope that inflation is starting to

recede and a sign in the US that annual wage growth may have peaked.

The US Federal Reserve

(Fed) has made it clear that the tightness of the US labour market is what it

is watching most keenly to determine whether inflation will return to target

over time. While the wage growth reading in the December payrolls report says

peak wage growth has passed, the strength of other readings including strong

non-farm payrolls growth (up 223,000 in December) and the unemployment rate

falling to 3.5% from 3.6% in November say that US labour market conditions are

still very tight.

Financial market

optimism in the first week of 2023 is likely to be challenged if the Fed sticks

to its script of doing what is necessary to return inflation to 2% target over

time. Even if annual US CPI inflation falls again when the December reading is

released later this week (market expectation +0.1% m-o-m, +6.5% y-o-y from

+0.1%, 7.1% in November), low unemployment in December and annual growth in

average hourly earnings although down to 4.6% y-o-y, still imply the best hope

for US annual inflation is that it falls to 4% over the next year, double the

Fed’s target.

The first Fed policy

meeting of 2023 at the end of this month is likely to see another hike in the

Fed funds rate from 4.50%, probably to 5.00% and that still may not be the last

rate hike.

Back in December,

financial markets were still attuned to the idea that not only the US Federal

Reserve, but most other central banks, still had more work ahead lifting

official interest rates. Major share markets mostly fell between 1.6% for the

FTSE 100 and 5.9% for the US S&P 500. Australia’s ASX 200 fell by

3.6%. Exceptions to the share market losses were China’s CSI 300, up 0.4%

and Hong Kong’s Hang Seng, up 5.9%, both markets responding positively to

China’s rapid removal of Covid restrictions.

Credit markets weakened

in December and like other markets have found a little strength early in 2023.

So far, the deterioration in Australian credit quality has been modest.

Essentially, very strong employment conditions are helping Australian

households cope with higher interest payments on debt. It remains less certain

whether Australia will experience recession in 2023 widely expected for the US

and Europe. A more resilient Australian economy than elsewhere may come with

the sting in the tail that the RBA has a relatively tougher task ahead bringing

inflation back to 2-3% target range. The RBA’s official interest rate

currently at 3.10% may not need to be raised much more, but it may need to be

held at a higher rate for longer and with relatively little leeway for rate

cuts further down the track.

Australian housing, the

most interest rate sensitive part of the Australian economy and already the

weakest part of the economy is likely to suffer further decline through 2023.

Previous RBA policy actions are having lagged effect on housing. Variable interest

rate mortgage borrowers are just starting to feel the impact in their monthly

repayments of the November and December RBA rate decisions.

Two and three-year fixed

rate mortgage borrowers who entered their commitment in boom-time numbers back

in 2020 and 2021 at very low interest rates face rolling over at monthly

repayments double and more in the first few months of 2023. Mortgage repayment

pain intensifies sharply early this year and could become acute later in the

year if the labour market weakens.

At the start of 2023 the

task facing the RBA remains challenging. Annual inflation may top out less than

8.0% y-o-y forecast previously courtesy of less extreme upward pressure on

petrol and food prices. However, the resilience of the economy and the labour

market point to inflation being stickier on the way down and unlikely to return

to 2-3% target band this year or next year.

|

|

Report To Ordinary Council MEETING

|

|

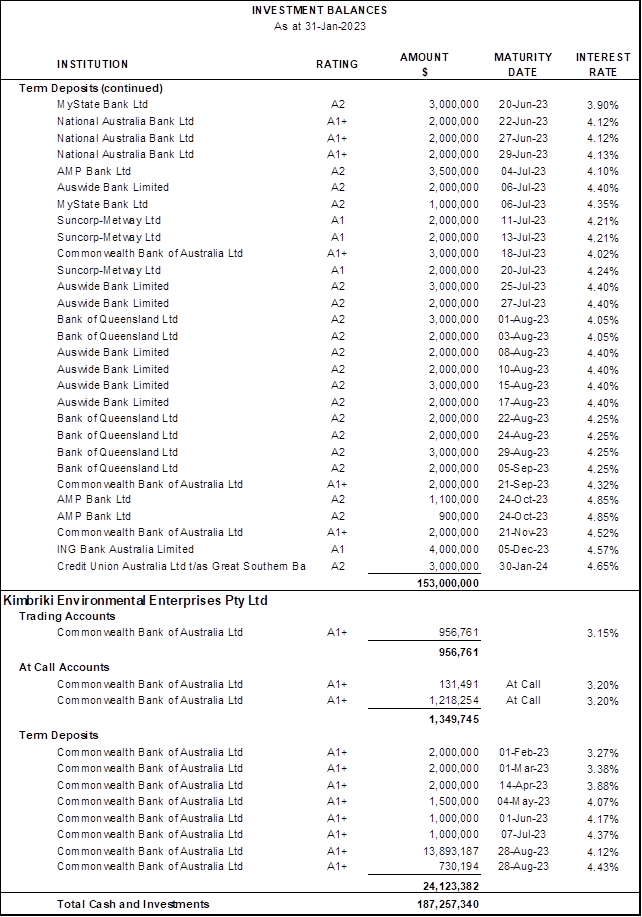

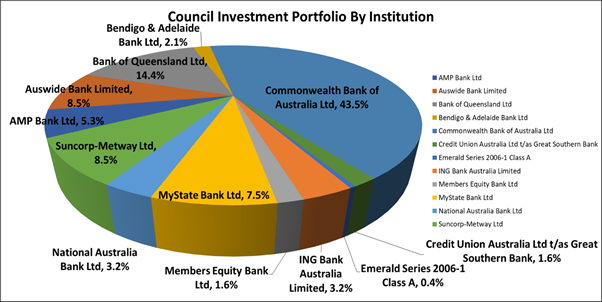

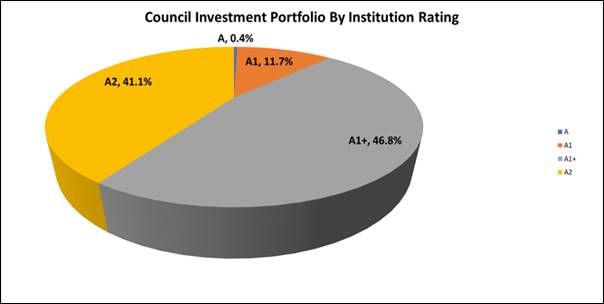

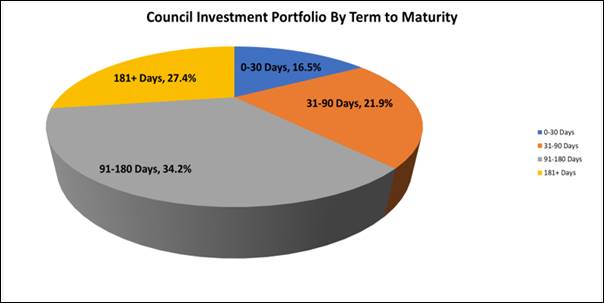

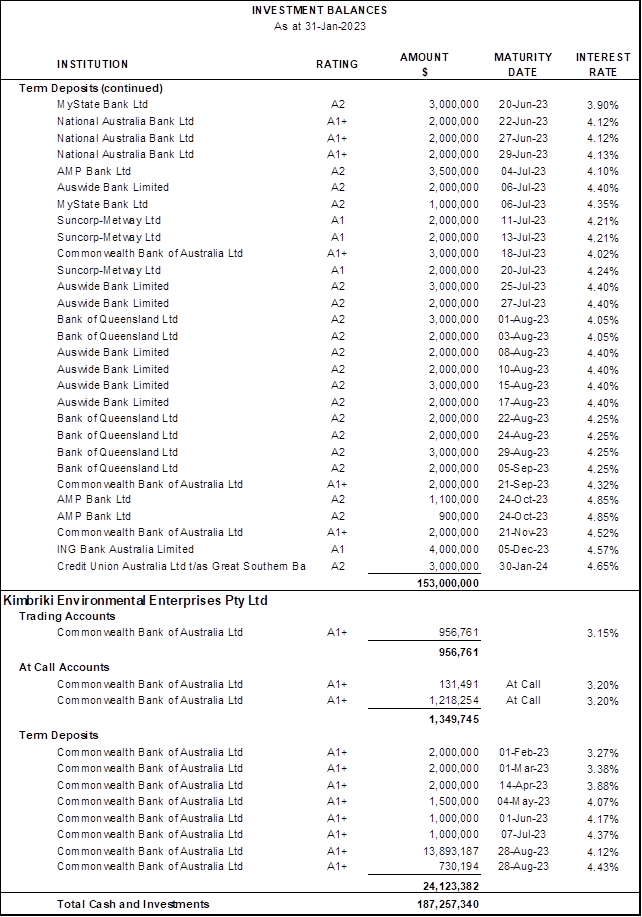

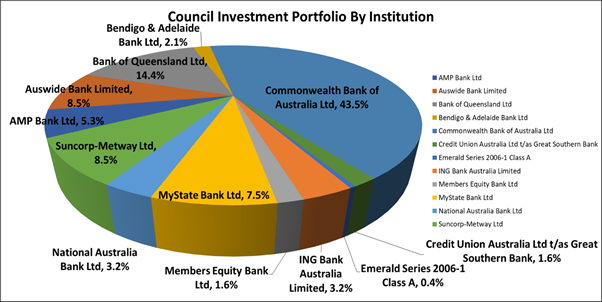

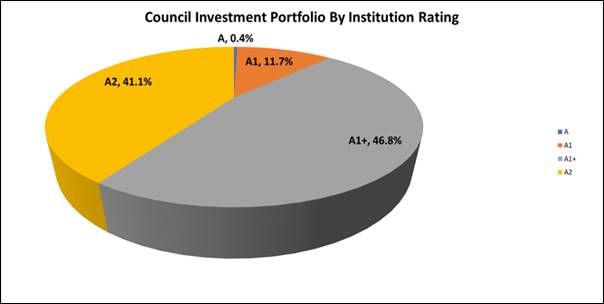

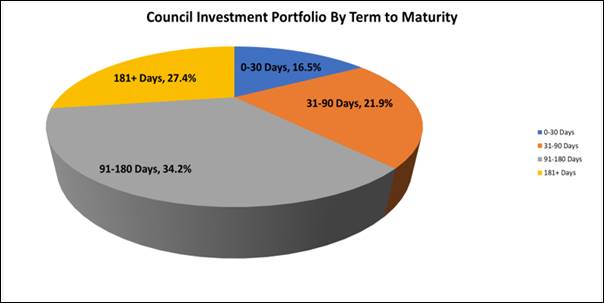

ITEM NO. 9.5 - 28 February 2023

|

pp

|

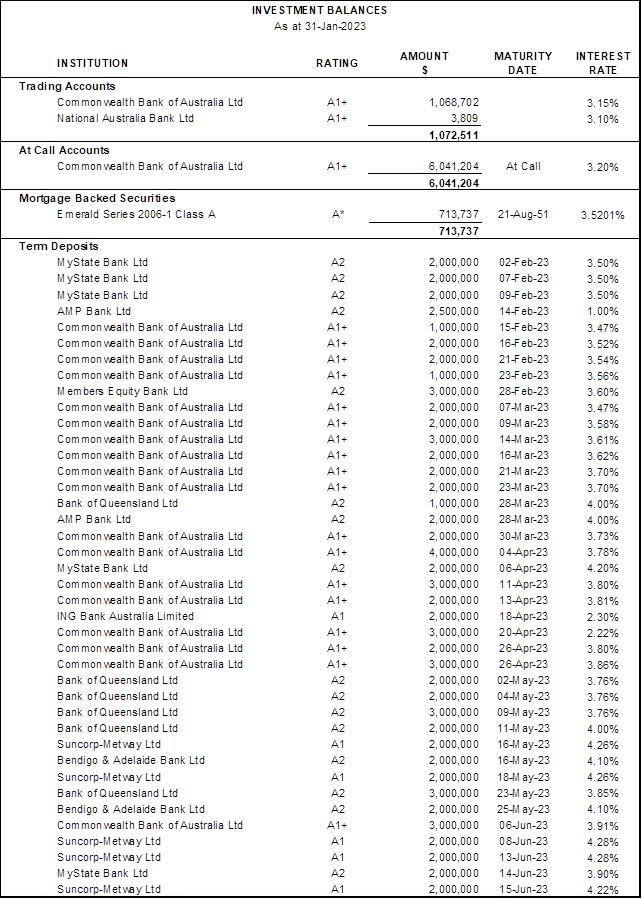

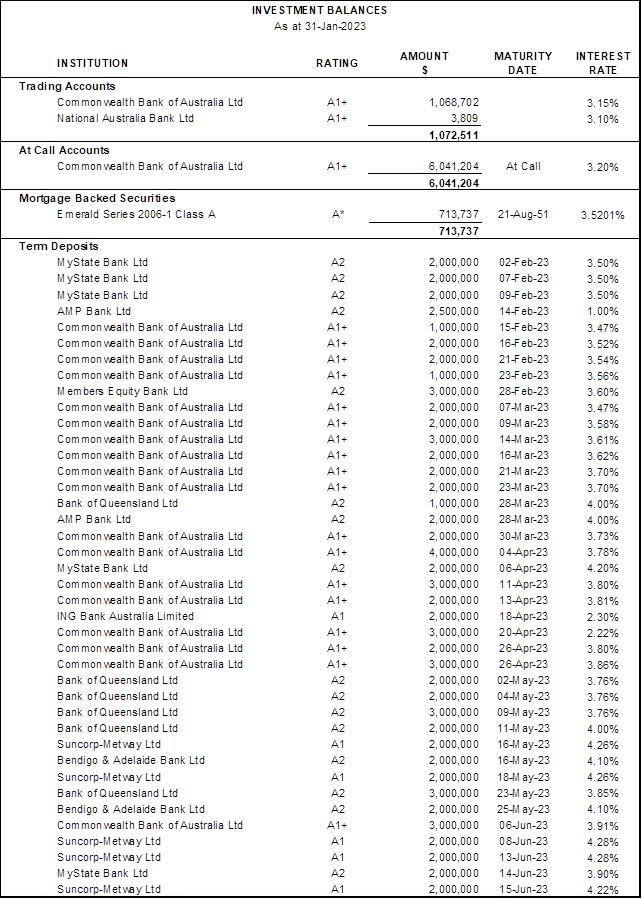

ITEM 9.5

|

Monthly

Investment Report - January 2023

|

|

REPORTING MANAGER

|

Chief

Financial Officer

|

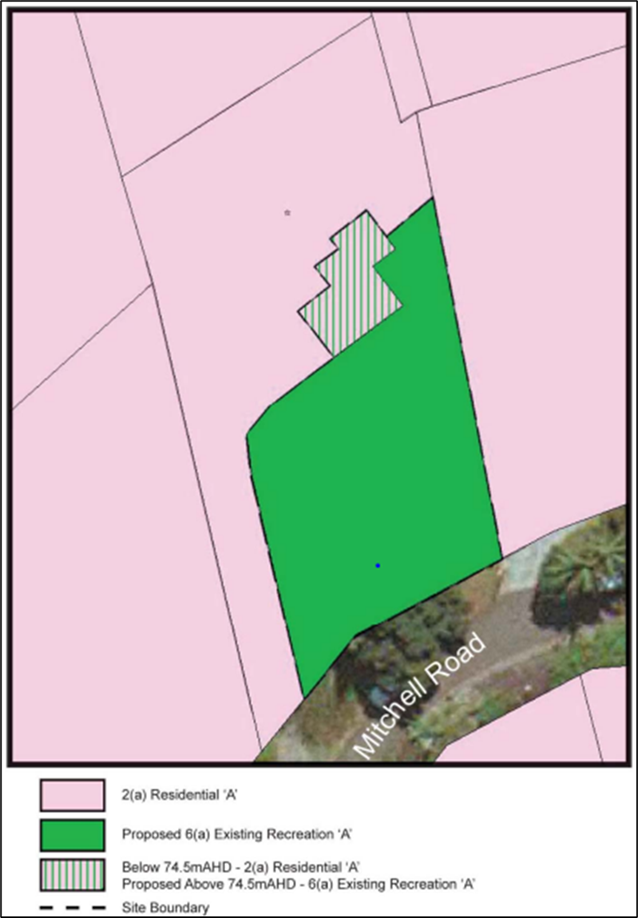

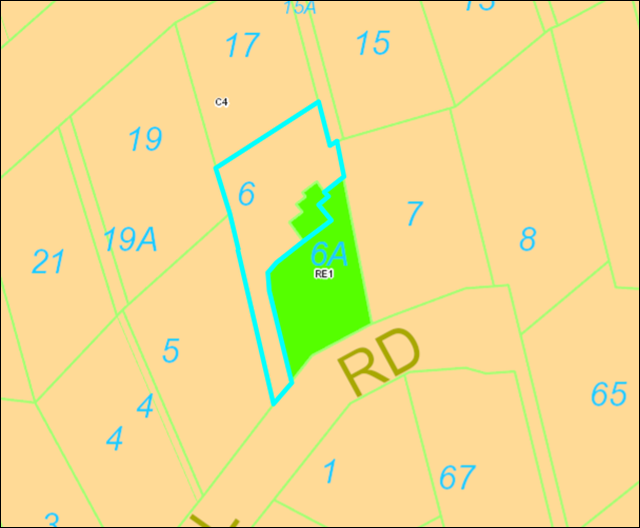

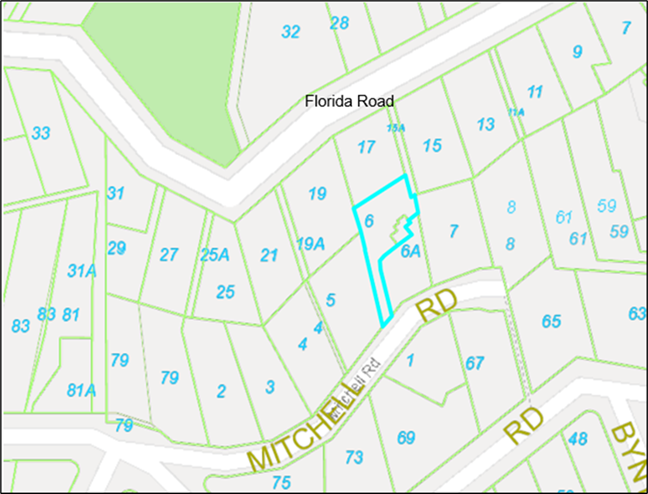

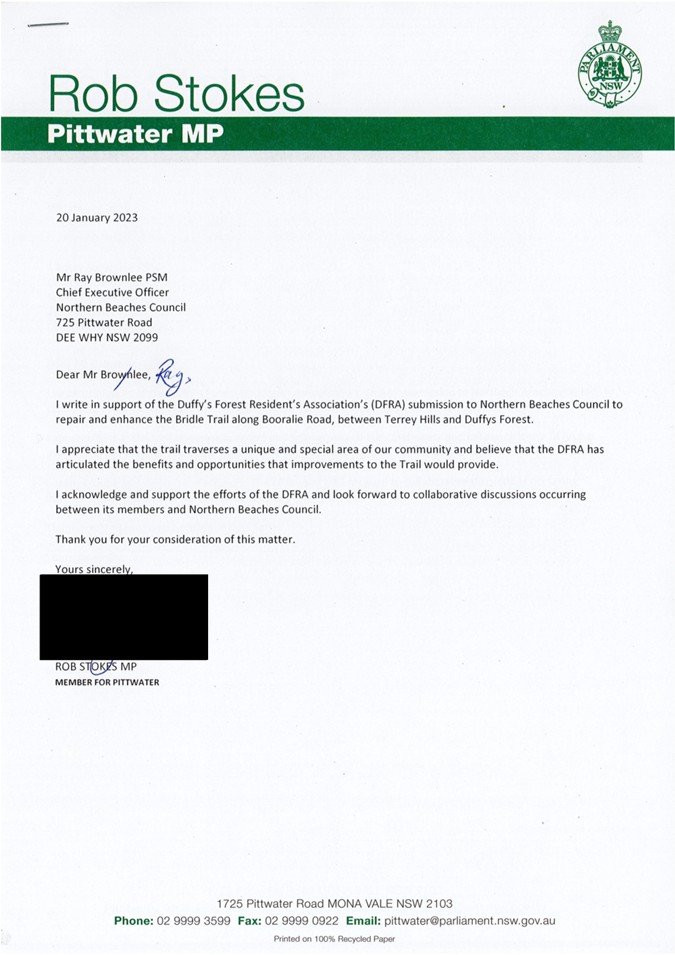

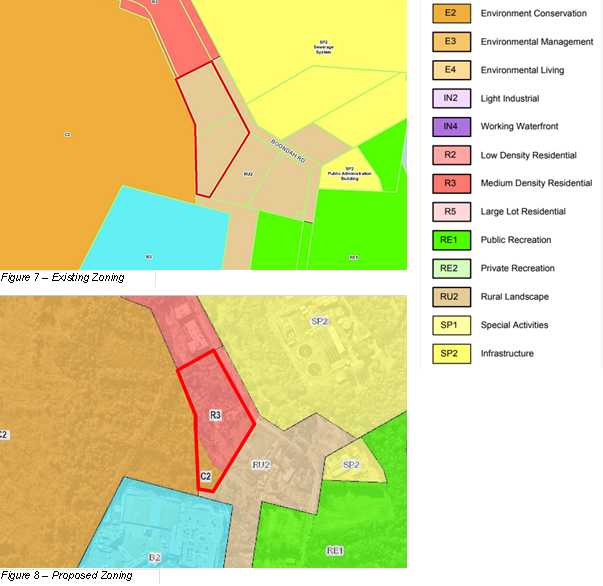

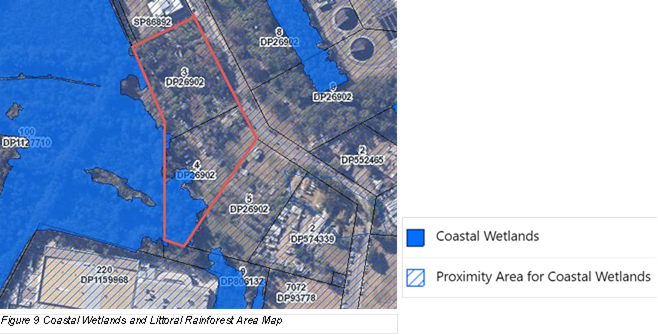

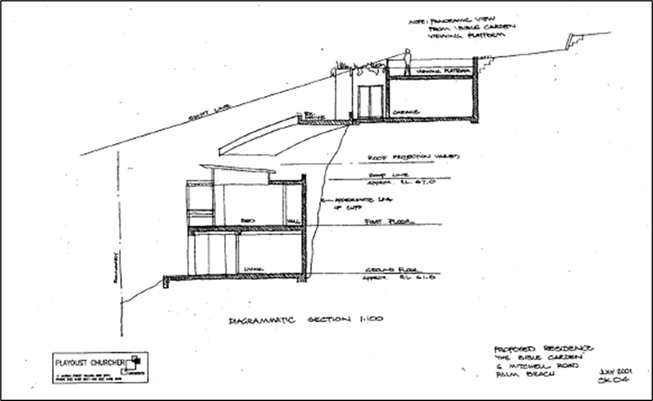

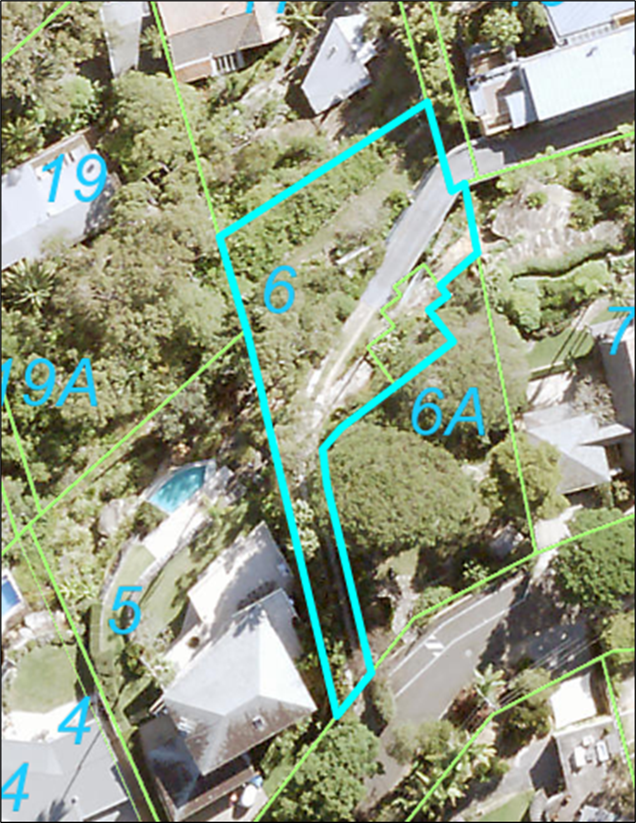

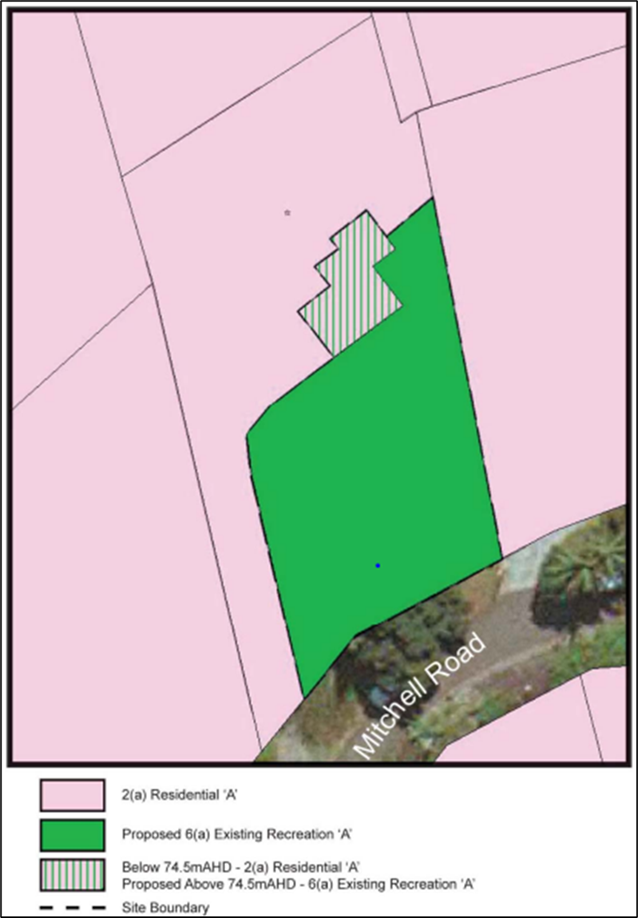

|